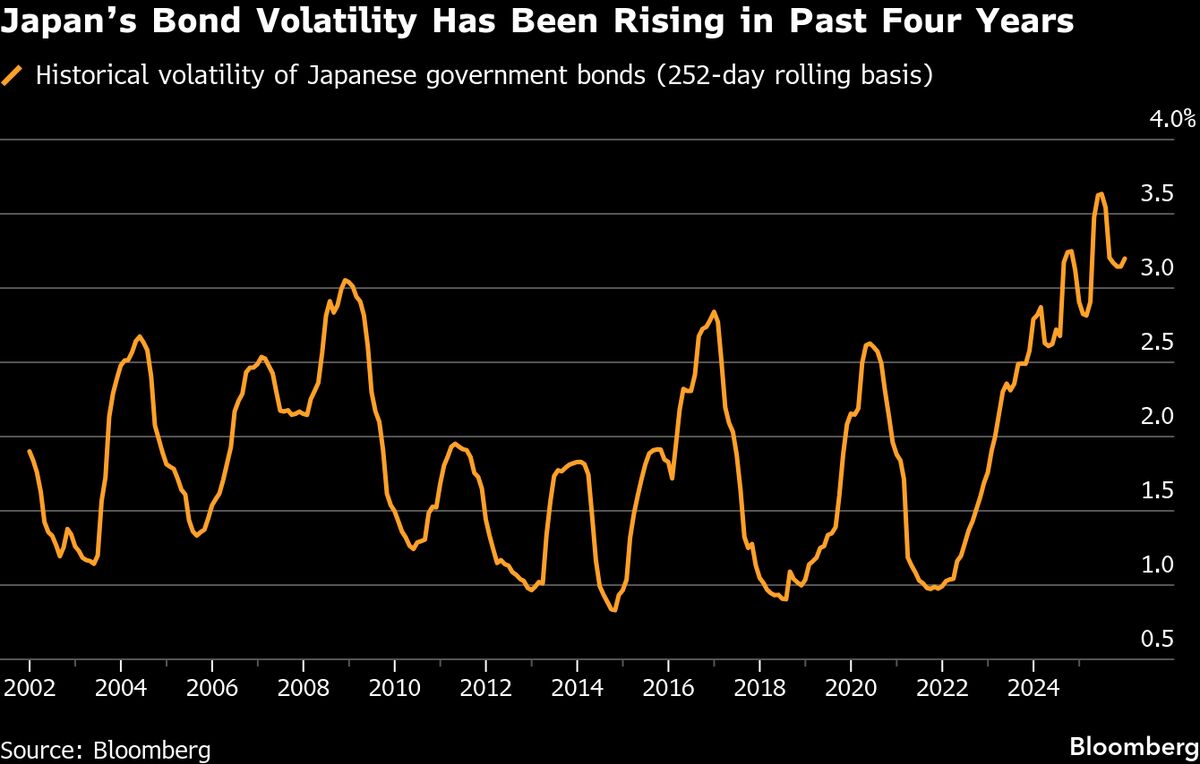

Foreign Traders Seize on Japan Bonds, Sparking Era of Volatility

NeutralFinancial Markets

- Foreign investors are increasingly entering Japan's government bond market, which has historically been stable, leading to heightened volatility influenced by external trading activities. This influx marks a significant shift in investor behavior towards Japan's sovereign debt, raising concerns about market stability.

- The surge in foreign interest in Japanese bonds indicates a potential transformation in the investment landscape, as these bonds are now subject to fluctuations driven by global market dynamics. This could impact Japan's economic policies and financial strategies moving forward.

- The current volatility in Japan's bond market reflects broader economic uncertainties, including concerns over fiscal policies and the effectiveness of Prime Minister Sanae Takaichi's stimulus measures. As the yen weakens and bond yields rise, investor sentiment remains cautious, highlighting the delicate balance Japan must maintain to attract investment while ensuring economic stability.

— via World Pulse Now AI Editorial System