Komatsu Falls as Operating Profit Slips to Three-Year Low

NegativeFinancial Markets

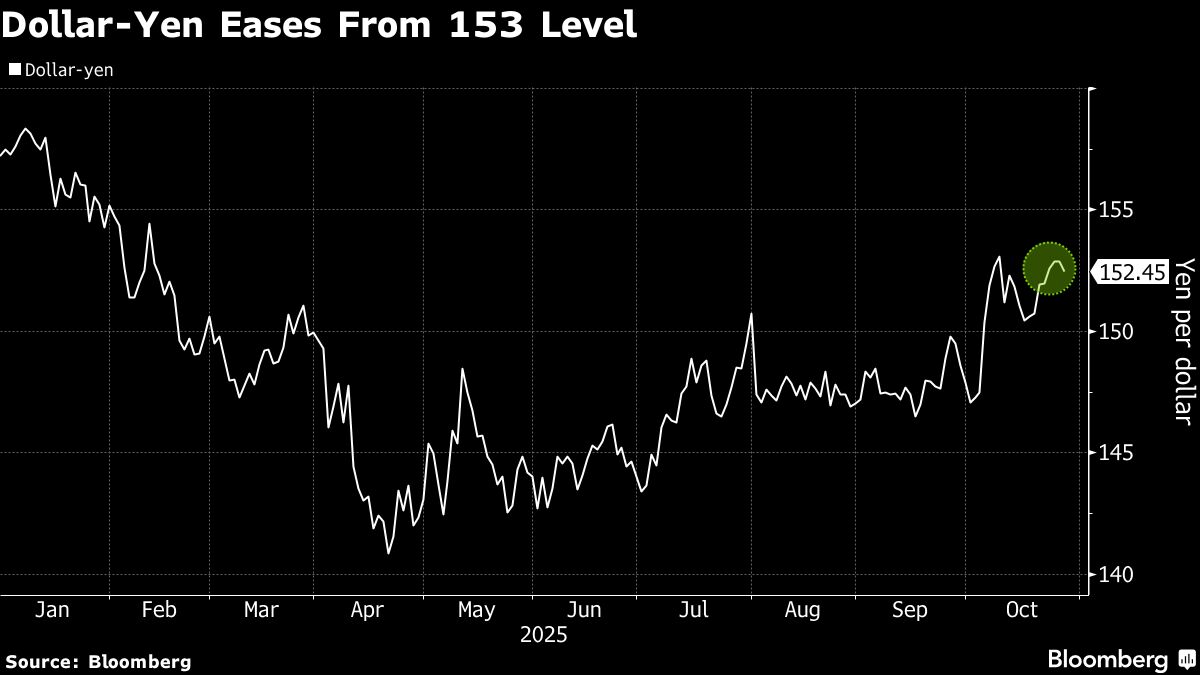

Komatsu Ltd. is facing challenges as its shares dropped following a report of the lowest operating profit in three years. The decline is attributed to a stronger yen, reduced shipment volumes, and increasing costs in its core business sectors, including construction and mining equipment. This situation is significant as it highlights the pressures on the company and the broader implications for the construction and mining industries.

— Curated by the World Pulse Now AI Editorial System