Fed’s Bowman calls for decisive rate cuts to address job market fragility

PositiveFinancial Markets

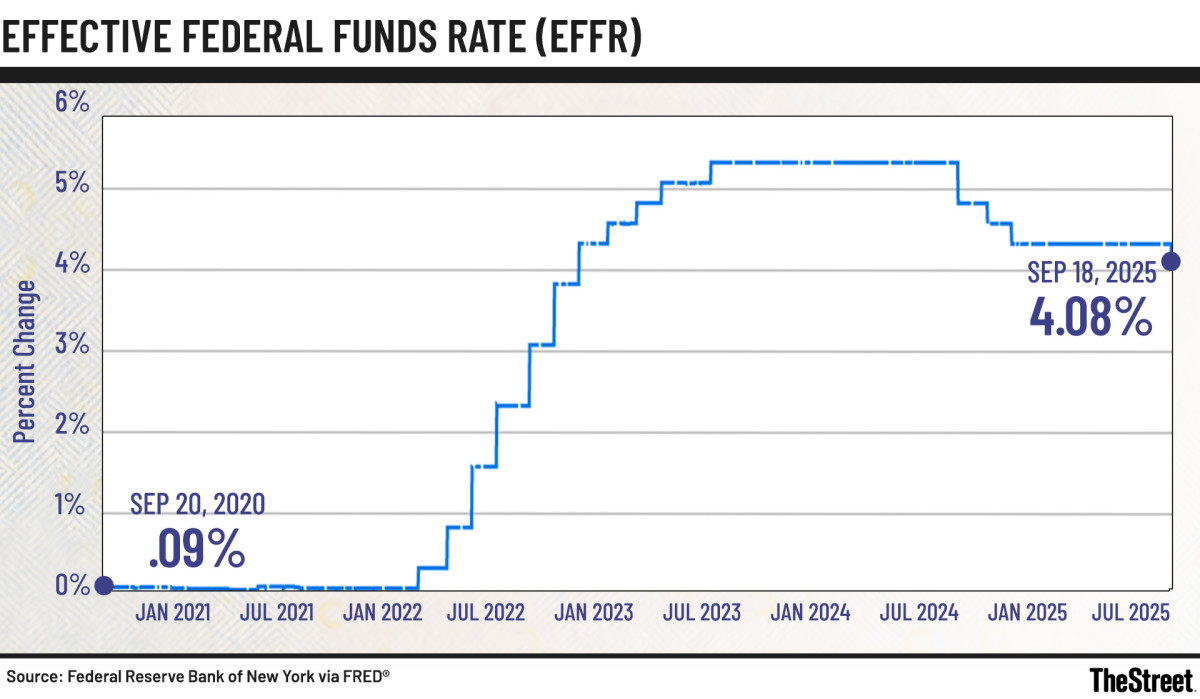

In a recent statement, Fed Governor Michelle Bowman emphasized the need for decisive rate cuts to strengthen the fragile job market. This call to action is significant as it highlights the ongoing challenges faced by workers and the economy, suggesting that lower interest rates could stimulate job growth and economic stability. Bowman's insights reflect a growing concern among policymakers about the balance between inflation control and employment, making this a crucial moment for economic strategy.

— Curated by the World Pulse Now AI Editorial System