China Trapped in Investment Slump as Infrastructure Bonds Dry Up

NegativeFinancial Markets

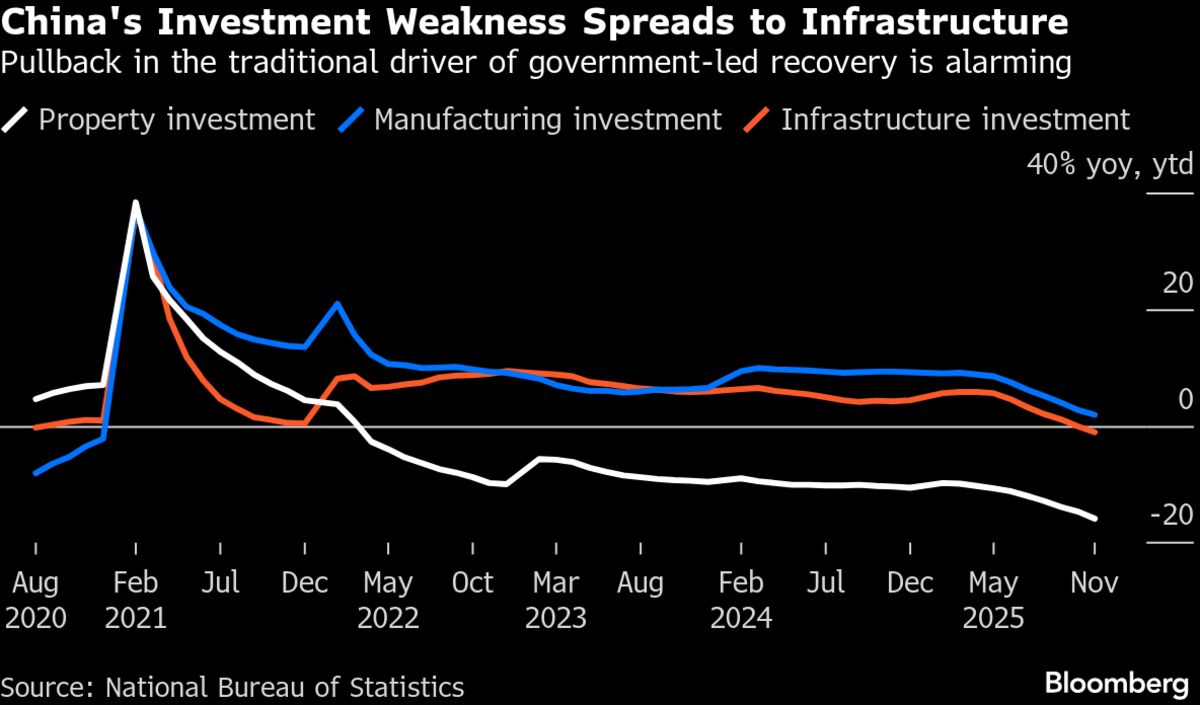

- China's local borrowing for infrastructure is projected to reach a six-year low as the government tightens regulations to mitigate financial risks, raising concerns about the country's ongoing investment slump. This shift in strategy comes amid a backdrop of declining investment levels across various sectors, including manufacturing and property.

- The decline in infrastructure bonds is significant as it indicates a potential slowdown in economic growth, which could hinder China's recovery from recent economic challenges and impact its global economic standing.

- This situation reflects a broader trend of declining investment in China, with the Communist Party expressing concerns over falling investment levels and the first annual decline in investment in three decades, highlighting the deepening economic issues facing the country.

— via World Pulse Now AI Editorial System