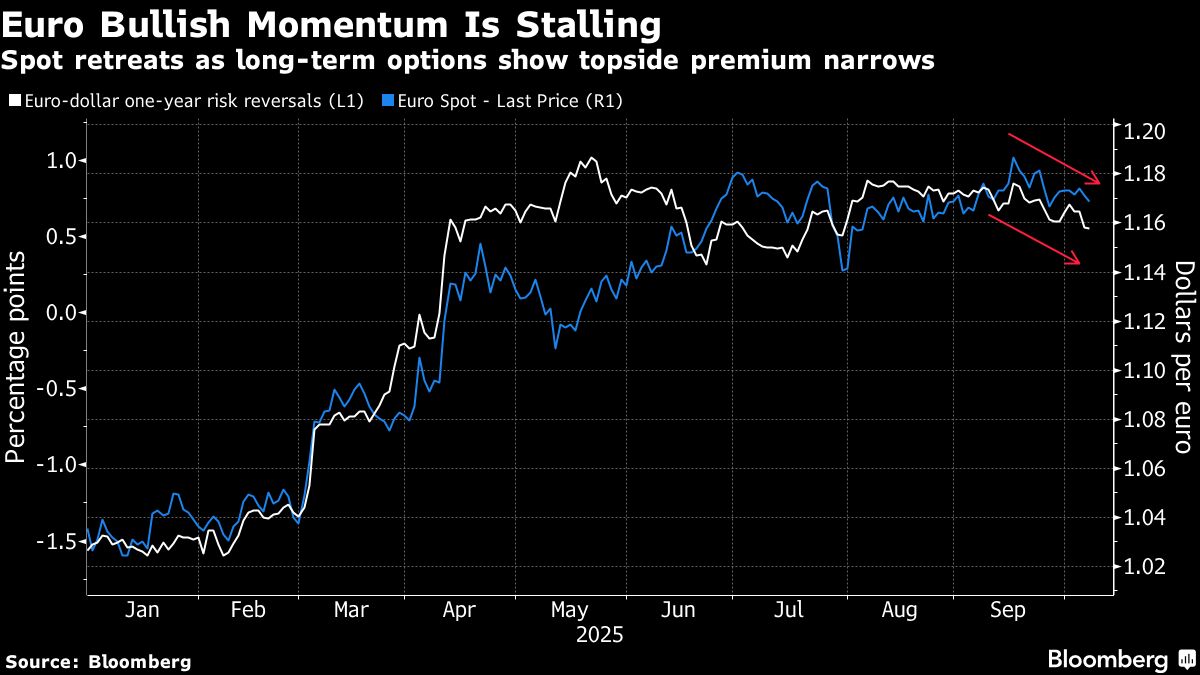

Euro’s Bullish Momentum Shows Cracks as French Risks Resurface

NegativeFinancial Markets

The euro is facing early signs of strain as political uncertainty in France begins to rise, prompting investors to reduce their exposure. This situation is significant because it highlights the fragility of the euro amidst ongoing political challenges, which could impact the broader European economy.

— via World Pulse Now AI Editorial System