Citigroup Expects Up to $20 Billion in India IPOs Over Next Year

PositiveFinancial Markets

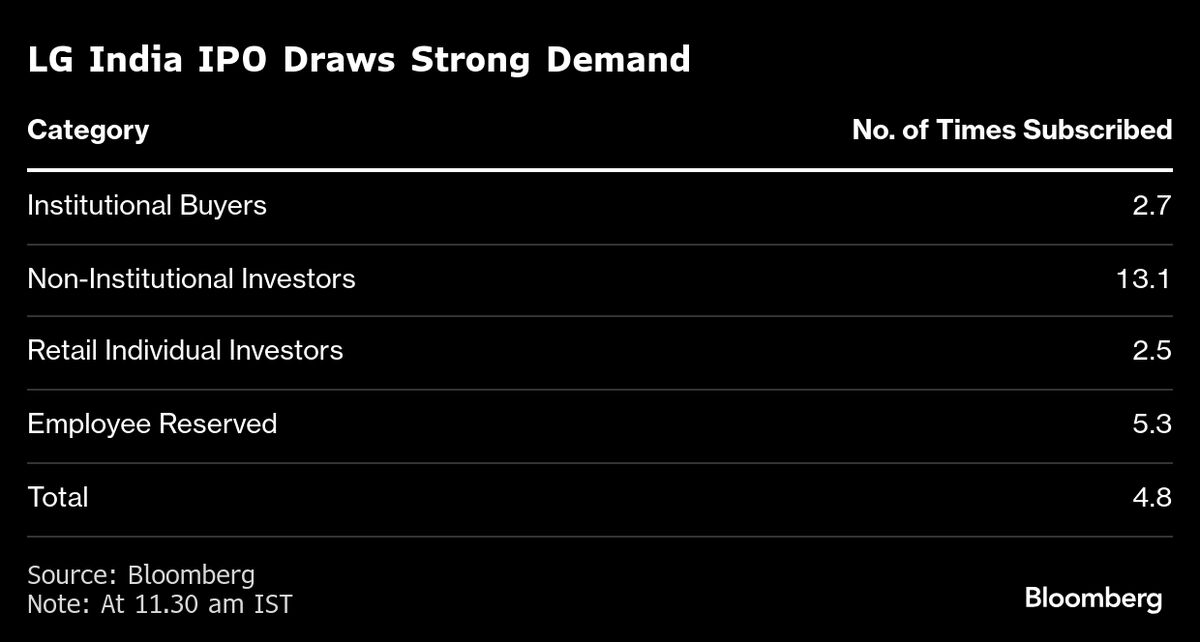

Citigroup has projected that initial public offerings (IPOs) in India could generate up to $20 billion in the coming year. This significant influx of capital is expected to bolster India's reputation as one of the leading markets for listings globally. The anticipated growth in IPO activity not only reflects investor confidence but also highlights the country's economic potential, making it an exciting time for businesses and investors alike.

— Curated by the World Pulse Now AI Editorial System