Citigroup Flags Oil Market’s Bearish Consensus as Surplus Looms

NegativeFinancial Markets

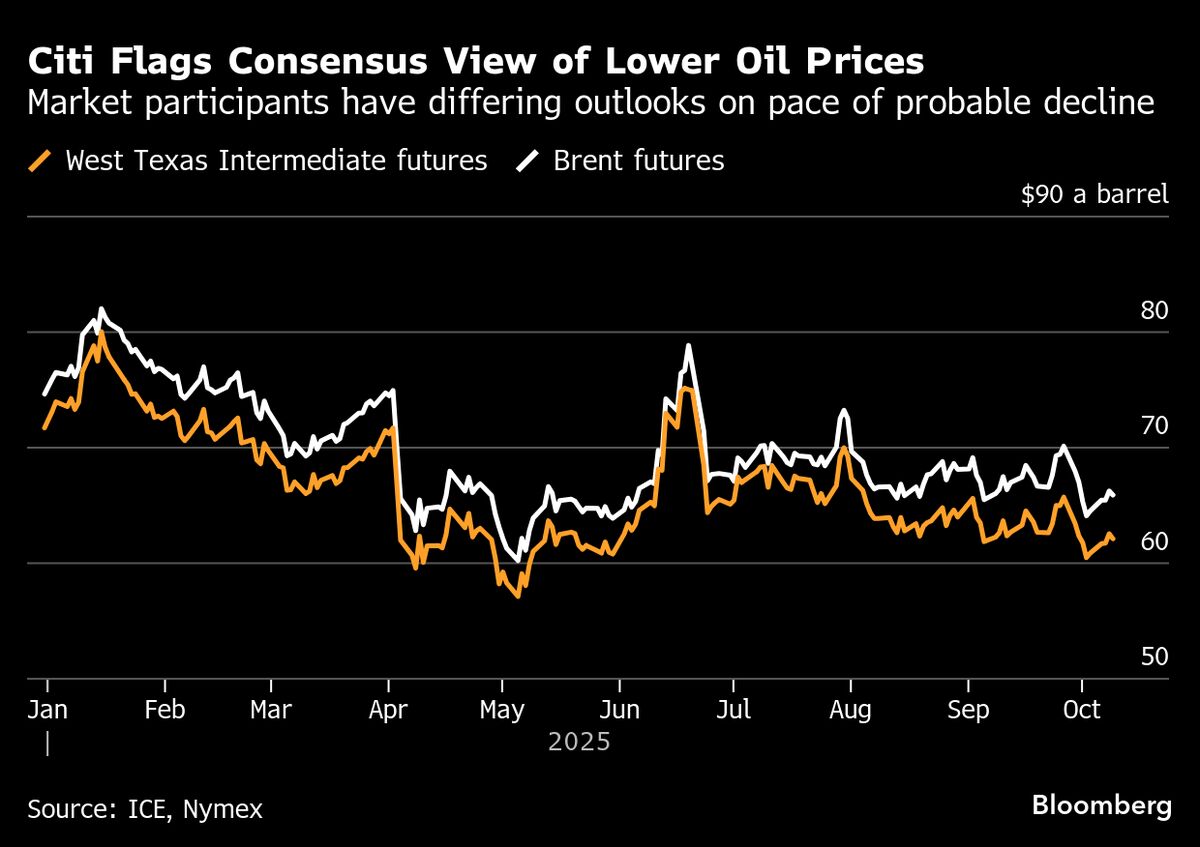

Citigroup has highlighted a bearish sentiment in the oil market, indicating that many clients in North America and Europe are concerned about a looming surplus. This matters because it reflects broader economic trends and could impact oil prices, affecting everything from consumer costs to global energy policies.

— Curated by the World Pulse Now AI Editorial System