Japan Is The 'Anti-Bubble': WisdomTree' Schwartz

NegativeFinancial Markets

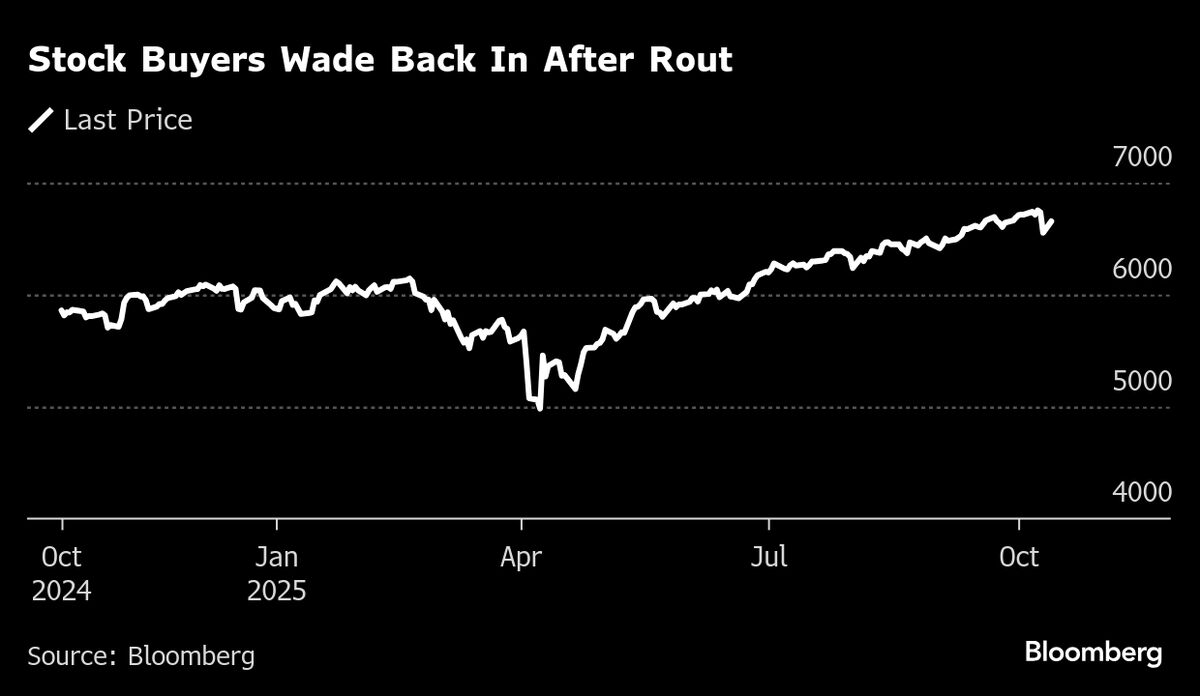

Japan is facing a significant political crisis after the abrupt collapse of its governing coalition, which has raised concerns about the stability of the new ruling party leader, Sanae Takaichi. This turmoil is not only a major setback for Japan but also has implications for global markets, as discussed by Jeremy Schwartz from WisdomTree. The situation is critical as it could affect the yen and the relationship with the US dollar, making it essential for investors to stay informed about these developments.

— Curated by the World Pulse Now AI Editorial System