Navan Sweeps Buy Ratings on AI Promise After Post-IPO Slump

PositiveFinancial Markets

- Navan Inc. received renewed support from Wall Street, with analysts labeling the corporate-travel and expense platform as undervalued following a significant selloff after its $923.1 million IPO last month. This shift in sentiment comes as the company seeks to stabilize its market position amidst fluctuating investor confidence.

- The positive reassessment by analysts is crucial for Navan as it aims to regain investor trust and attract new capital, which is essential for its growth and operational strategies in a competitive sector.

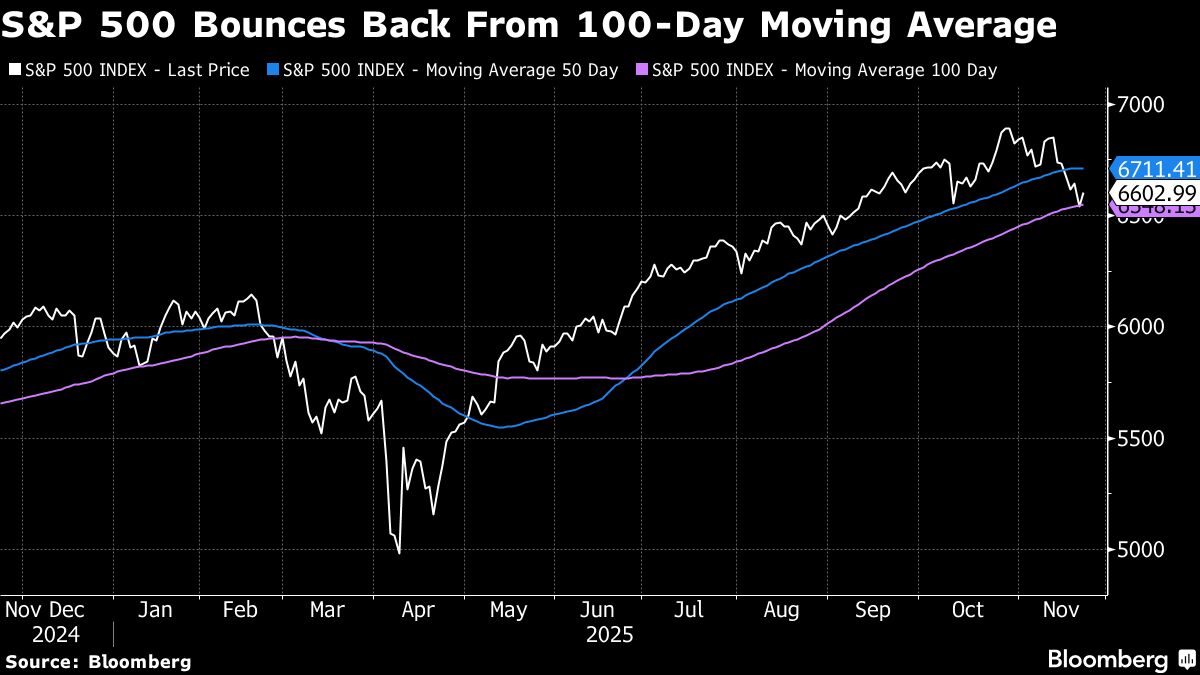

- This development reflects a broader trend in the market, where technology companies, particularly those linked to artificial intelligence, are experiencing volatility but also potential recovery, as seen with Nvidia's strong earnings that have rejuvenated investor interest in AI-driven stocks.

— via World Pulse Now AI Editorial System