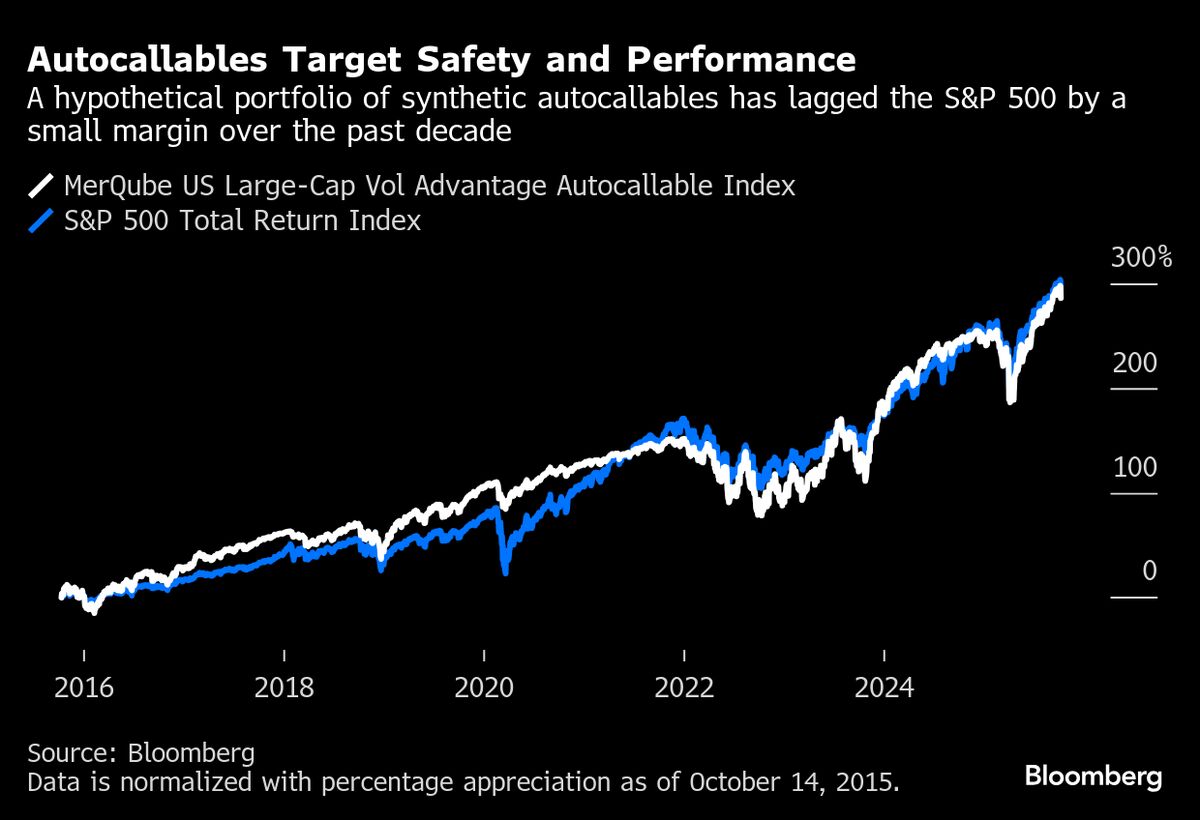

Wall Street Crams More Autocallables Into ETFs in Race for Yield

PositiveFinancial Markets

Wall Street is innovating in the investment landscape by incorporating single-stock autocallables into ETFs, moving away from traditional income-enhanced strategies. This shift is significant as it reflects a growing demand for yield in a low-interest environment, offering investors new opportunities to enhance returns. As these derivatives gain traction, they could reshape how investors approach risk and income generation in their portfolios.

— Curated by the World Pulse Now AI Editorial System