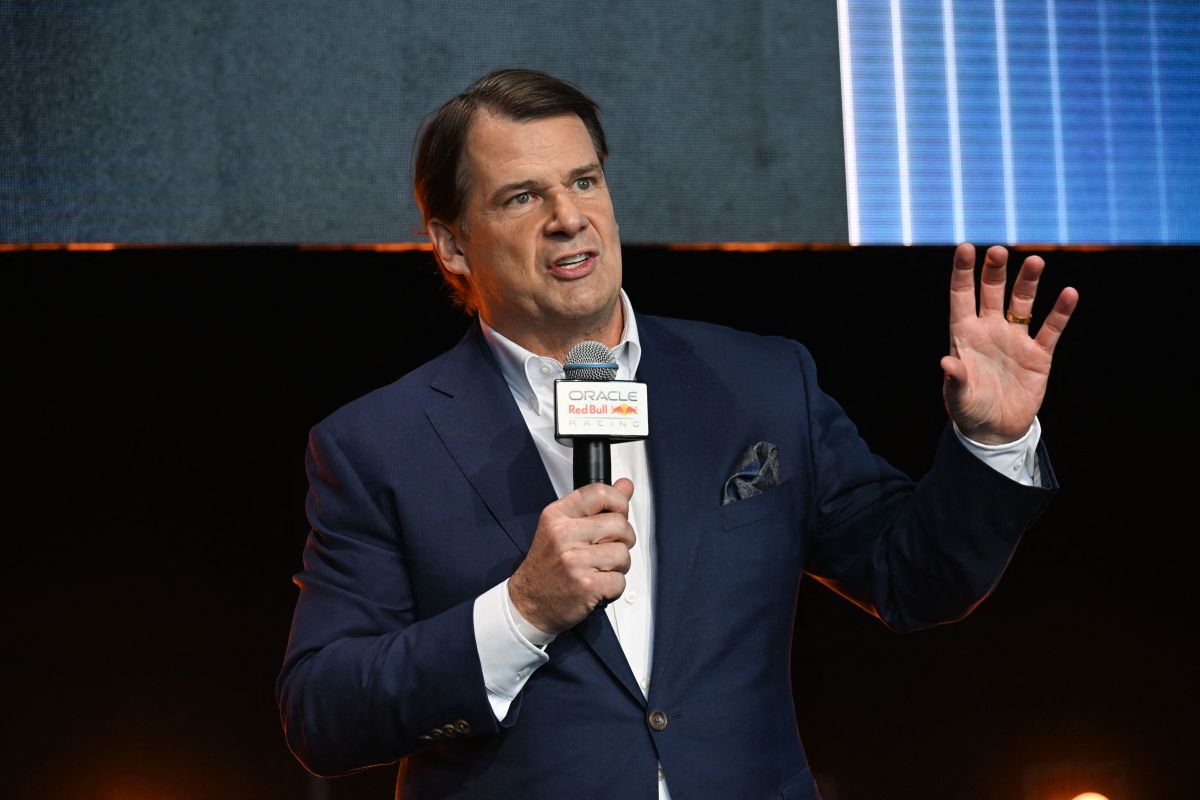

Ford to take $19.5 billion writedown as it scraps flagship EVs

NegativeFinancial Markets

- Ford has announced a $19.5 billion writedown as it abandons several flagship electric vehicle models, including the F-150 Lightning, due to weak demand and unfavorable policies from the Trump administration. This decision marks a significant shift in the company's electric vehicle strategy, reflecting ongoing challenges in the U.S. auto industry.

- This substantial financial loss highlights the difficulties Ford faces in its transition to electric vehicles, as it reevaluates its approach amid declining sales and increased competition. The company is now shifting focus towards gas and hybrid vehicles, which may impact its long-term EV ambitions.

- The broader context reveals a struggling electric vehicle market in the U.S., exacerbated by regulatory changes and the expiration of tax incentives. Other automakers are also grappling with similar challenges, indicating a turbulent period for the industry as it attempts to balance innovation with market realities.

— via World Pulse Now AI Editorial System