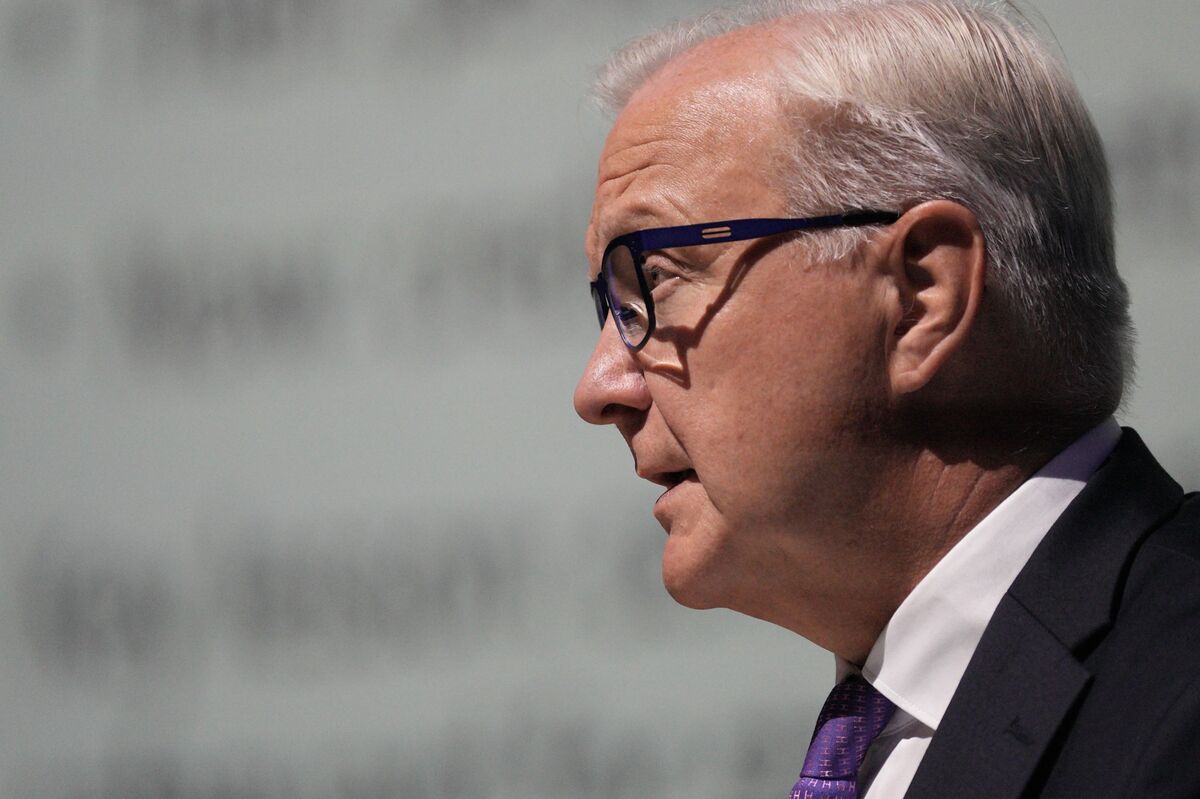

ECB’s Escrivá Warns of Unprecedented Level of Economic Uncertainty

NegativeFinancial Markets

José Luis Escrivá, a member of the European Central Bank's Governing Council, has raised alarms about the unprecedented levels of economic uncertainty currently facing Europe. This warning is significant as it highlights the challenges that policymakers and businesses must navigate in an unpredictable economic landscape, potentially impacting investment decisions and consumer confidence.

— Curated by the World Pulse Now AI Editorial System