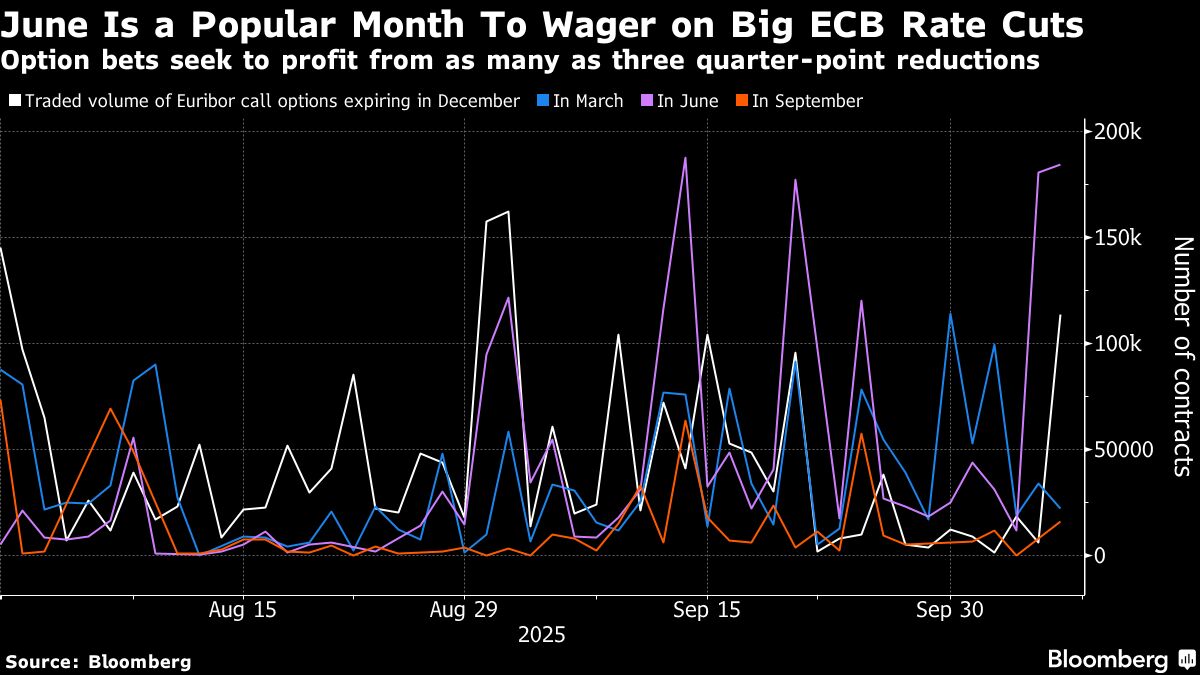

Traders Seeking 30-Fold Returns Target Big ECB Rate Cuts by June

PositiveFinancial Markets

Traders are optimistic about the potential for significant profits as they place bets on the European Central Bank (ECB) making substantial interest rate cuts by June. This speculation suggests that if the ECB surprises the market with aggressive rate reductions, it could lead to a 30-fold return on their investments. Such moves would not only impact the financial markets but also reflect broader economic trends, making it a crucial development for investors and economists alike.

— Curated by the World Pulse Now AI Editorial System