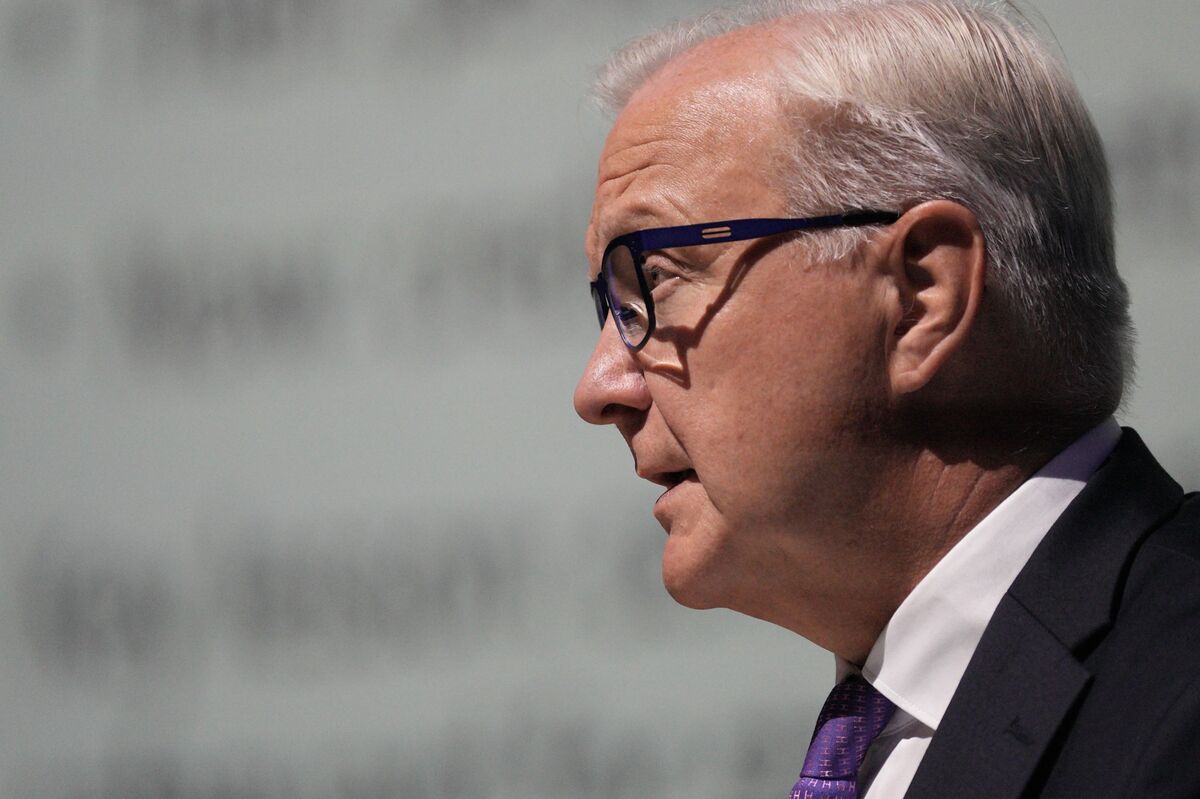

ECB’s Rehn Warns of Looming Downside Risks to Inflation Outlook

NegativeFinancial Markets

Olli Rehn, a member of the European Central Bank's Governing Council, has raised concerns about potential downside risks to the inflation outlook, indicating that consumer-price growth may fall below the ECB's target of 2%. This warning is significant as it highlights the challenges the Eurozone faces in maintaining price stability, which is crucial for economic recovery and consumer confidence.

— Curated by the World Pulse Now AI Editorial System