Bessent’s brag

NeutralFinancial Markets

- Treasury Secretary Scott Bessent has raised questions about the administration's influence over the Treasury market, suggesting a potential shift in how economic policies are perceived and implemented. His remarks come amid ongoing discussions about the national debt and economic strategies under the current administration.

- This development is significant as it highlights Bessent's role in shaping economic policy and his perspective on the Treasury's operations, which could impact investor confidence and market dynamics.

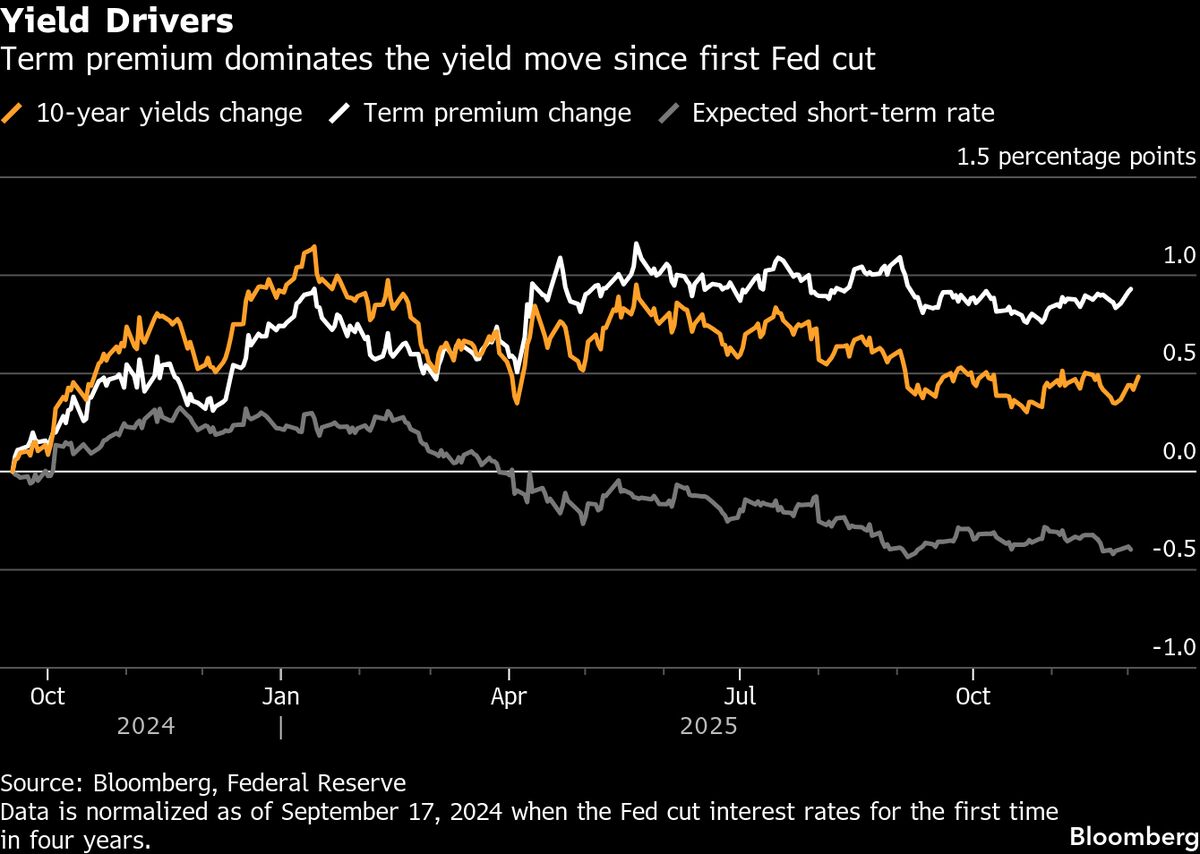

- The discourse surrounding Bessent's comments reflects broader concerns regarding fiscal responsibility, the implications of tariffs on Treasury revenues, and the evolving relationship between government policy and market behavior, particularly in light of recent fluctuations in Treasury yields.

— via World Pulse Now AI Editorial System