Bond Traders Defy Fed and Spark Heated Debate on Wall Street

NeutralFinancial Markets

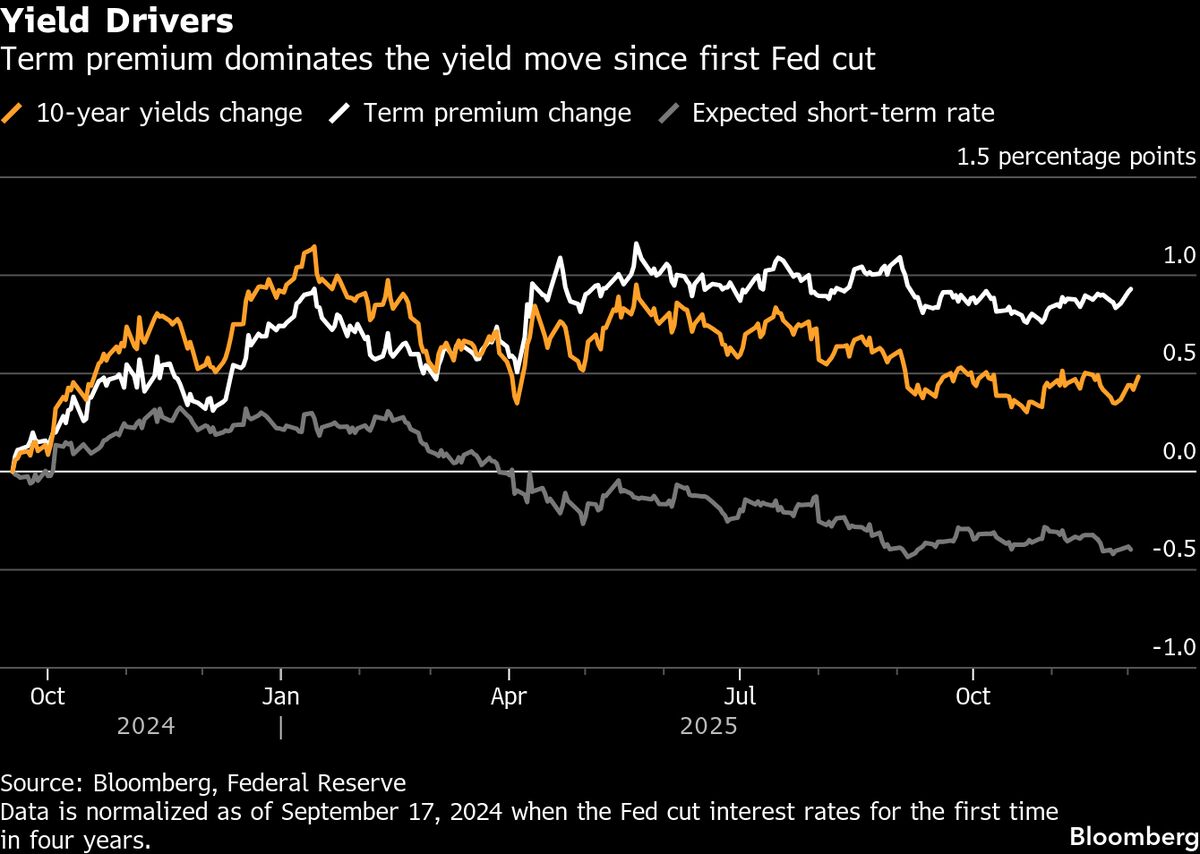

- The bond market has reacted unusually to the Federal Reserve's recent interest-rate cuts, with Treasury yields rising despite the central bank's decision to lower rates, a phenomenon not observed since the 1990s. This divergence has sparked significant debate among traders and analysts on Wall Street.

- This development is critical as it indicates a potential disconnect between market expectations and the Federal Reserve's monetary policy, raising questions about the effectiveness of rate cuts in stimulating economic growth and influencing investor behavior in the bond market.

- The ongoing discussions within the Federal Reserve regarding future rate cuts reflect broader uncertainties in the economic landscape, particularly concerning labor market conditions. As traders increasingly bet on further cuts, the market's response highlights contrasting views on the central bank's ability to navigate economic challenges and the implications for Treasury yields.

— via World Pulse Now AI Editorial System