European Stocks Hit Record High as Investors Bet on Fed Cuts

PositiveFinancial Markets

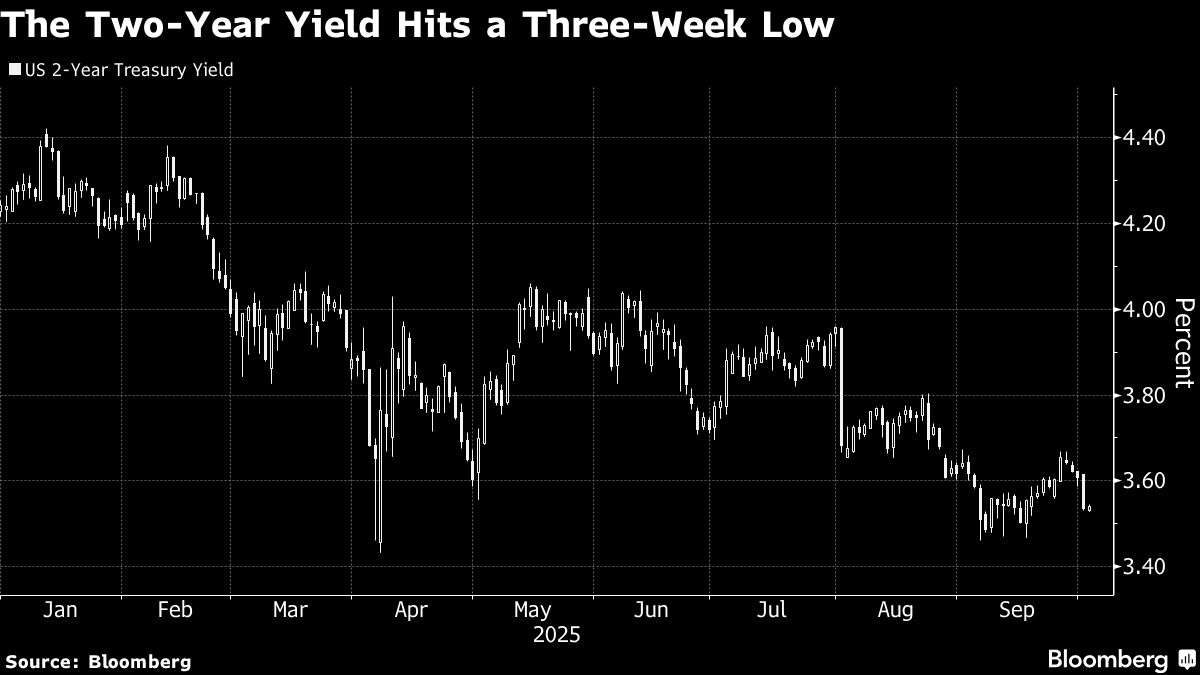

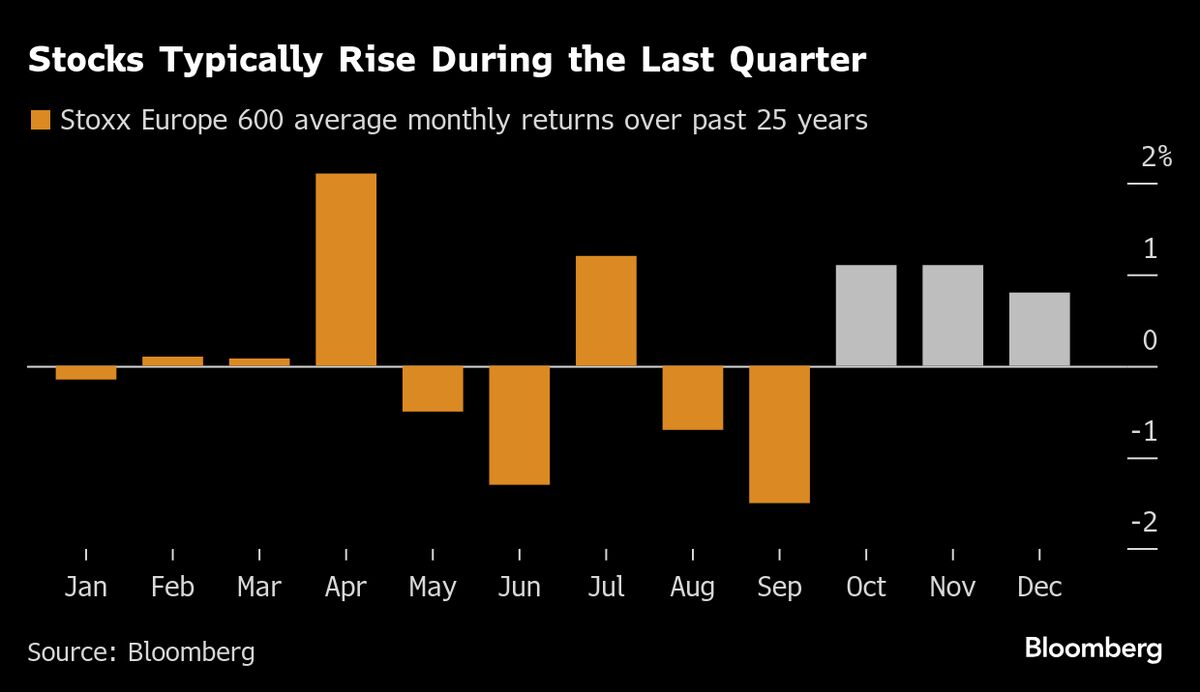

European stocks have reached a record high as investors are increasingly optimistic about potential interest-rate cuts from the Federal Reserve, driven by recent disappointing economic data. This rally reflects a growing confidence in the market, suggesting that investors believe lower rates could stimulate economic growth and boost corporate profits, making it a significant moment for the European financial landscape.

— Curated by the World Pulse Now AI Editorial System