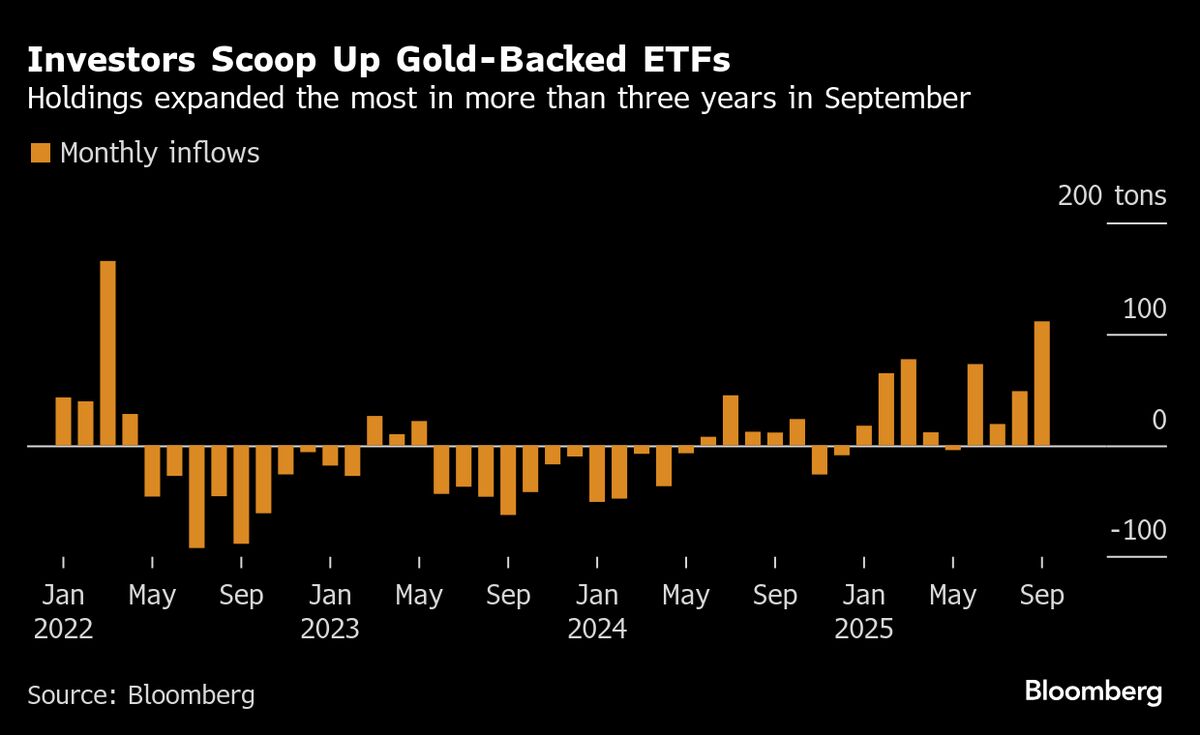

Gold Holds Five-Day Rally on Fed Cut Bets, US Shutdown Concerns

PositiveFinancial Markets

Gold prices have been on a remarkable five-day rally, reaching new heights as concerns about a potential US government shutdown loom. This surge is largely driven by traders betting on interest rate cuts from the Federal Reserve, especially after disappointing private payrolls data. This trend is significant as it reflects investor confidence in gold as a safe haven during uncertain economic times.

— Curated by the World Pulse Now AI Editorial System