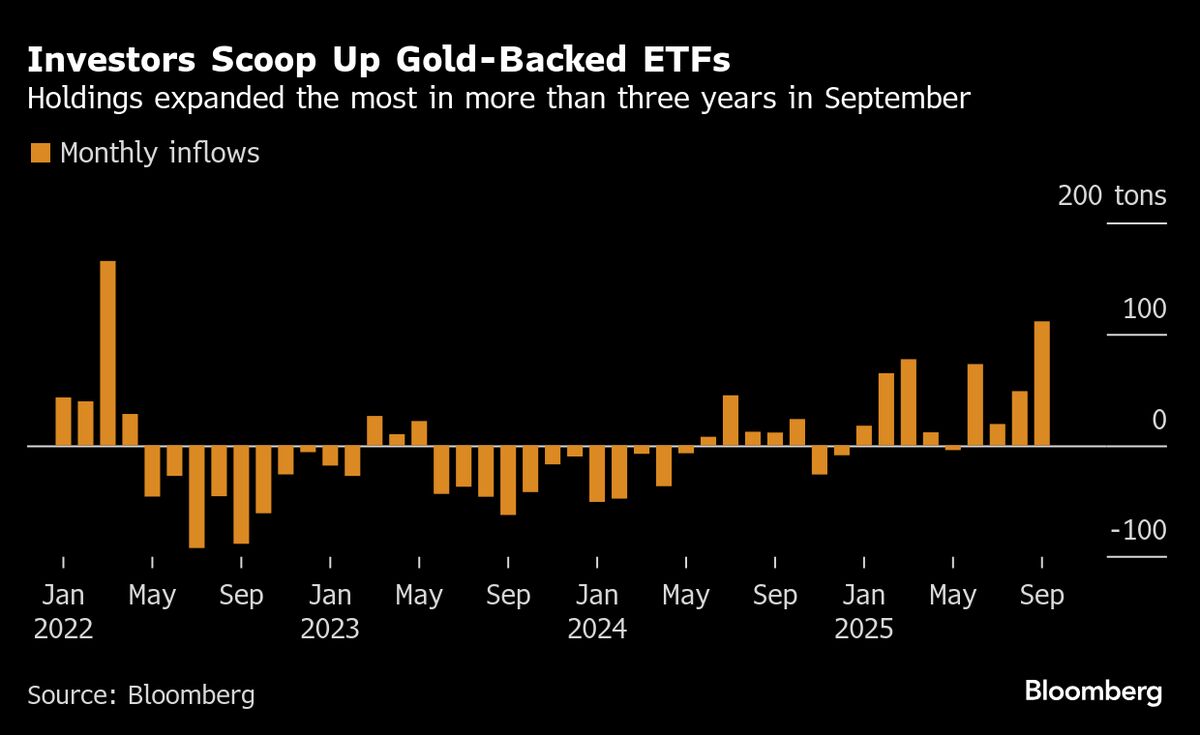

Goldman Sachs Sees More Upside for Gold on Private Interest

PositiveFinancial Markets

Goldman Sachs is optimistic about gold's future, suggesting that the precious metal could rise even more than expected. This is largely due to increasing interest from private investors, which indicates a strong demand for gold as a safe-haven asset. As economic uncertainties persist, this trend could have significant implications for both investors and the broader market.

— Curated by the World Pulse Now AI Editorial System