Investors Pile Into Funds Betting on Elusive Market Volatility

NegativeFinancial Markets

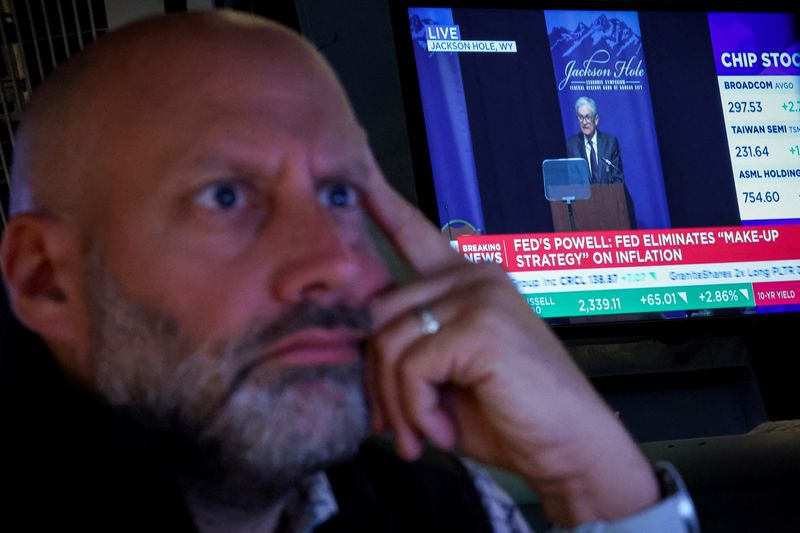

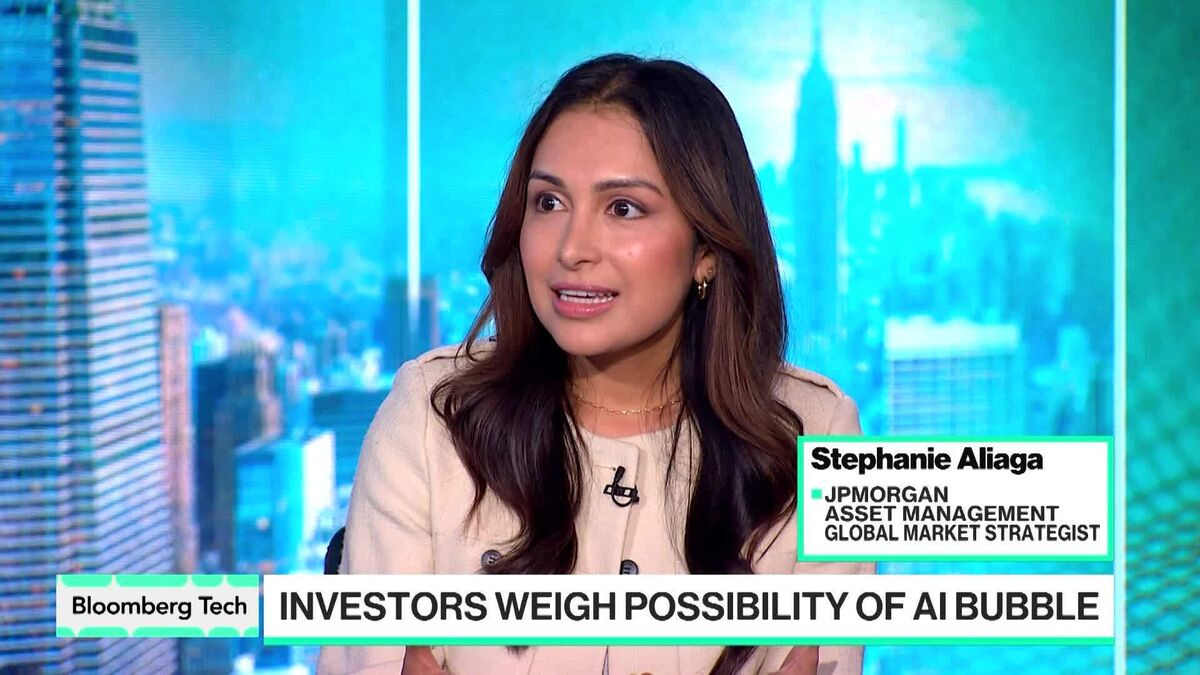

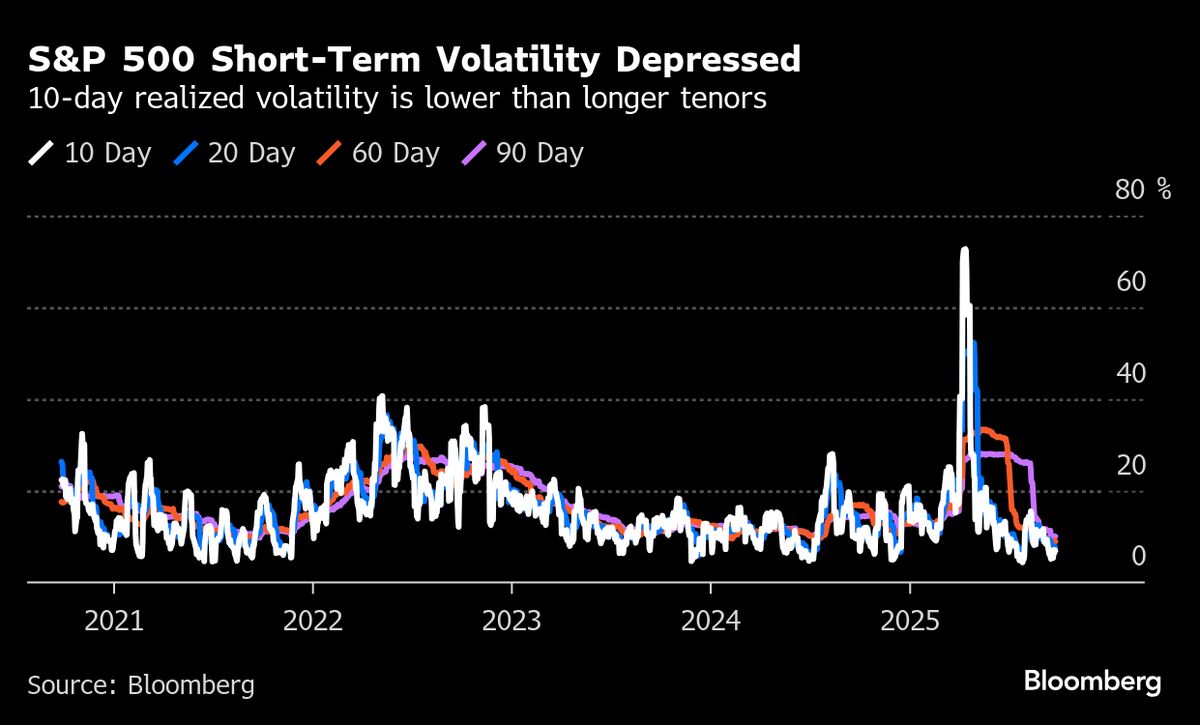

Investors are increasingly turning to exchange-traded products in hopes of capitalizing on a rise in stock-market volatility, which has been at historically low levels. However, as they await a significant spike, many are facing dwindling returns due to a peculiar market dynamic. This situation highlights the challenges investors face in navigating market fluctuations and the risks associated with timing their investments.

— Curated by the World Pulse Now AI Editorial System