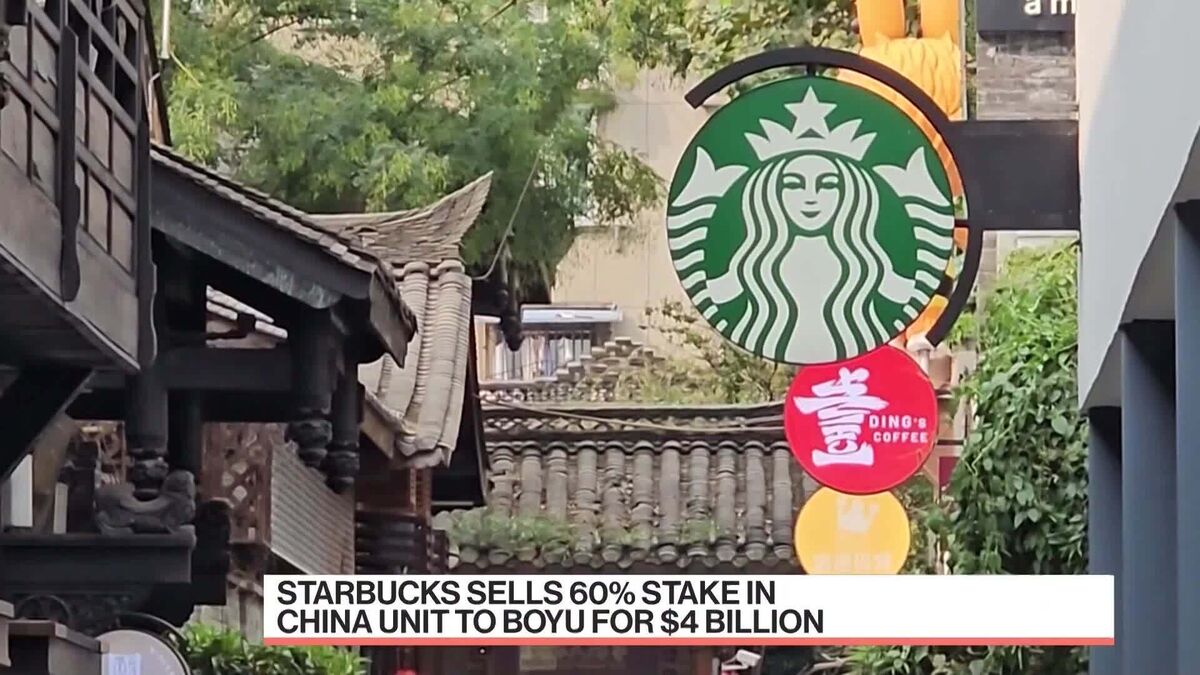

Starbucks to sell 60% stake in China business to Boyu Capital

PositiveFinancial Markets

Starbucks is set to sell a 60% stake in its China business to Boyu Capital, a move that highlights the growing interest in the Chinese market. This strategic decision not only allows Starbucks to focus on its core operations but also brings in significant investment to enhance its presence in one of the world's largest coffee markets. The partnership with Boyu Capital is expected to drive innovation and expansion, making it a win-win for both parties.

— Curated by the World Pulse Now AI Editorial System