Tech Deal, Rate Cut Push Stocks to Records

PositiveFinancial Markets

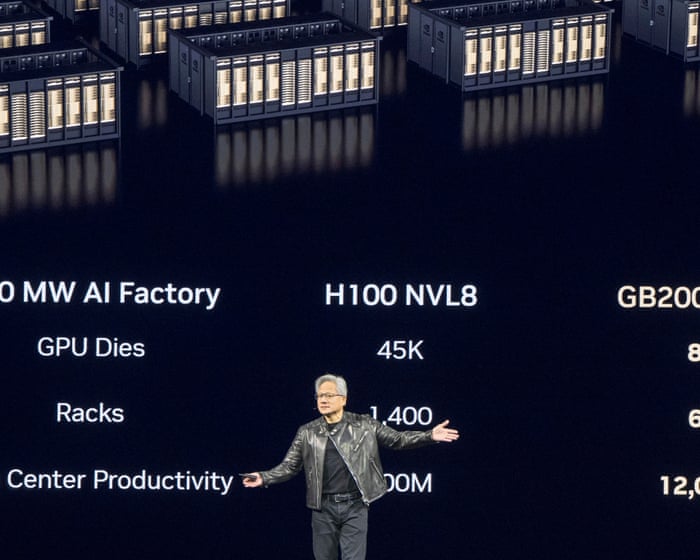

In a remarkable turn of events, Intel experienced its best day since 1987 following a substantial $5 billion investment from Nvidia. This surge in stock prices, fueled by optimism around tech deals and potential rate cuts, highlights the growing confidence in the technology sector. Investors are excited about the implications of these developments, as they could signal a robust recovery and growth in the market.

— Curated by the World Pulse Now AI Editorial System