How Intel’s Nvidia deal could help Intel’s next generation of chip manufacturing

PositiveFinancial Markets

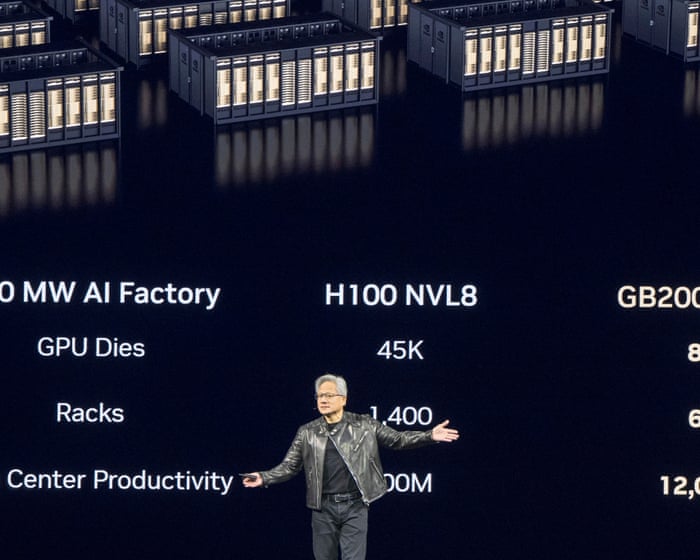

Intel's recent collaboration with Nvidia is set to revolutionize its chip manufacturing process. This partnership not only enhances Intel's technological capabilities but also positions the company to better compete in the rapidly evolving semiconductor market. By leveraging Nvidia's expertise, Intel aims to produce more efficient and powerful chips, which could lead to significant advancements in various tech sectors, from gaming to artificial intelligence. This deal is a promising step for Intel as it seeks to regain its footing in an industry dominated by competitors.

— Curated by the World Pulse Now AI Editorial System