Earnings Doubts Reign as BYD Stock Set for Fifth Month of Losses

NegativeFinancial Markets

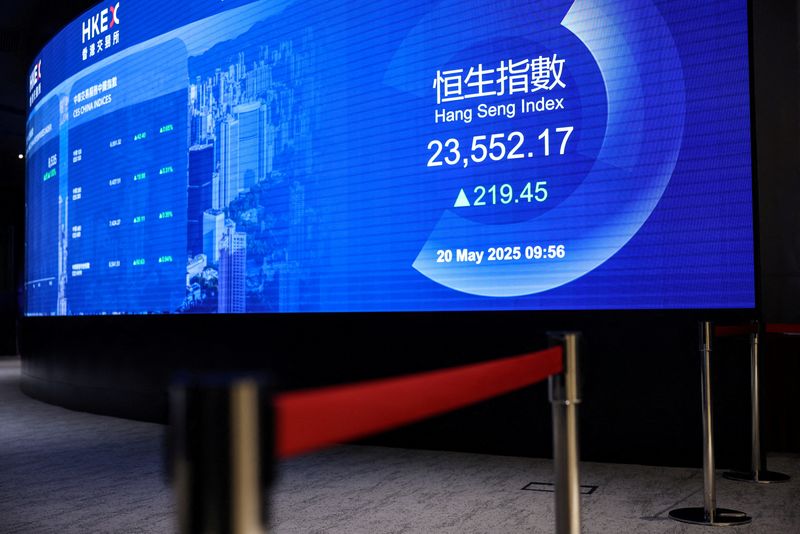

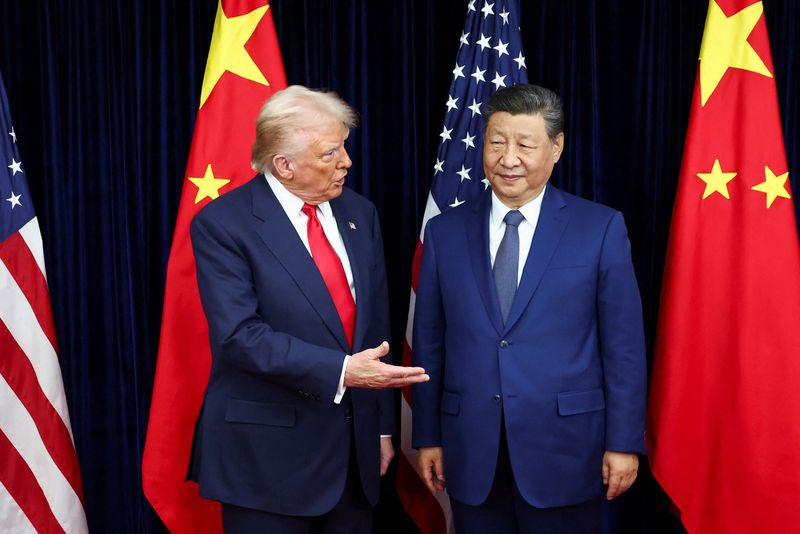

BYD Co. is facing a challenging time as its Hong Kong-listed shares are on track for their fifth consecutive month of losses, the longest streak since 2018. This downturn reflects growing investor skepticism about the company's ability to compete effectively in the Chinese market. The situation is significant as it highlights the pressures faced by companies in a competitive landscape, raising questions about their future performance and strategies.

— Curated by the World Pulse Now AI Editorial System