The fracturing of the world economy

NeutralFinancial Markets

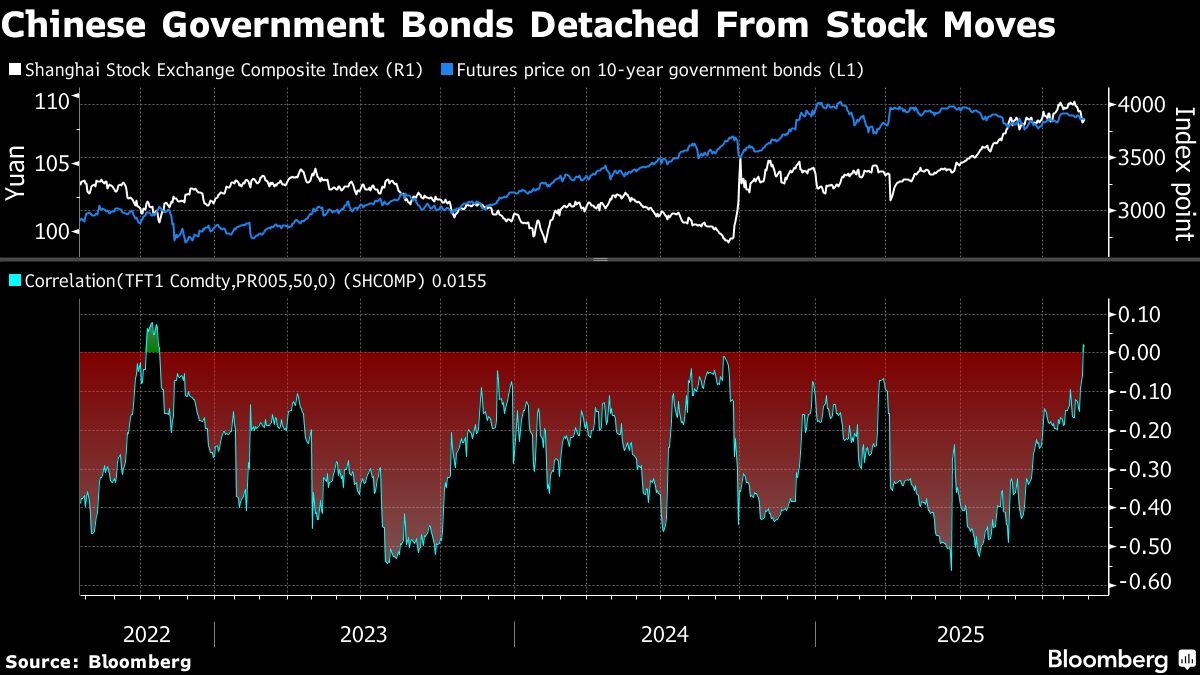

- The global economy is facing significant fractures as tensions between the US and China escalate, raising questions about which nation will change its current economic strategies first. This situation is compounded by various market indicators and geopolitical dynamics that influence investor sentiment and economic policies.

- The outcome of this economic rivalry is crucial for both countries, as their decisions will impact global trade, investment flows, and economic stability. Investors are closely monitoring developments, particularly in light of recent economic reports that could signal shifts in market trends.

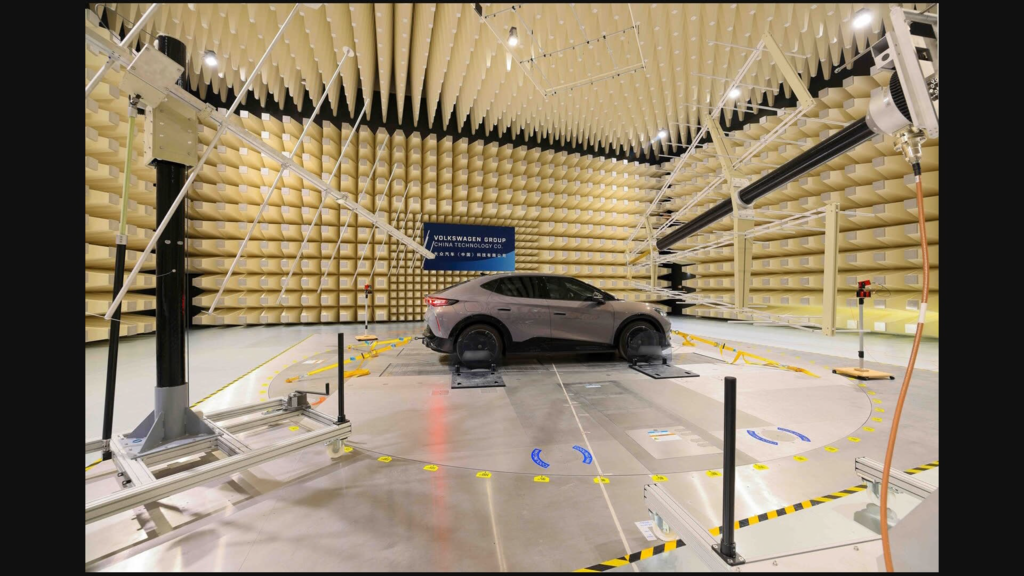

- Broader economic themes are emerging, including concerns over China's investment downturn and the implications of American exceptionalism in trade. As China seeks to assert its leadership in climate action amidst reduced US participation, the interconnectedness of global markets highlights the complexities of this economic landscape.

— via World Pulse Now AI Editorial System