Asian Stocks Extend Gains on Fed Rate-Cut Bets: Markets Wrap

PositiveFinancial Markets

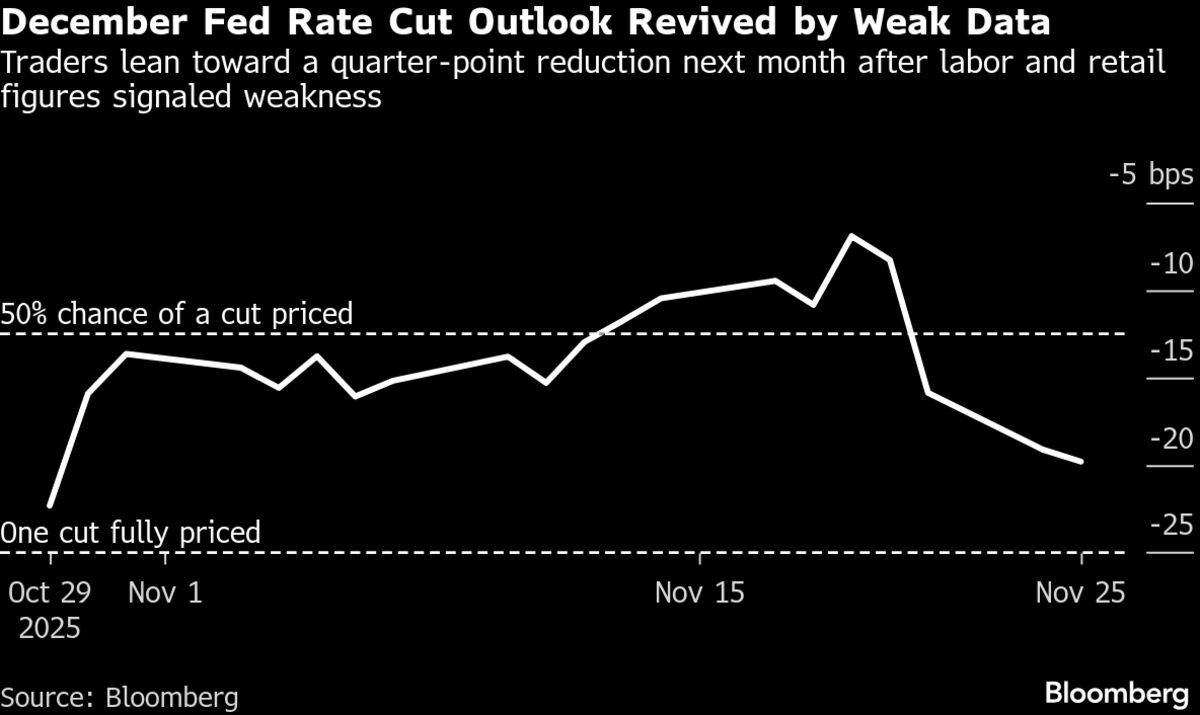

- Asian stocks have extended their gains for a third consecutive day, buoyed by positive movements on Wall Street as weak U.S. consumer data has increased expectations for a Federal Reserve interest rate cut next month.

- This development is significant as it reflects growing investor confidence in the potential for lower borrowing costs, which could stimulate economic activity and support stock market performance across regions.

- The broader market sentiment is shaped by ongoing discussions about the Federal Reserve's monetary policy, with recent signals from Fed officials suggesting a willingness to adjust rates, amidst mixed economic indicators and concerns about inflation and tech market volatility.

— via World Pulse Now AI Editorial System