Continued Expansion of Breadth in Market in 2026: Dudley

NeutralFinancial Markets

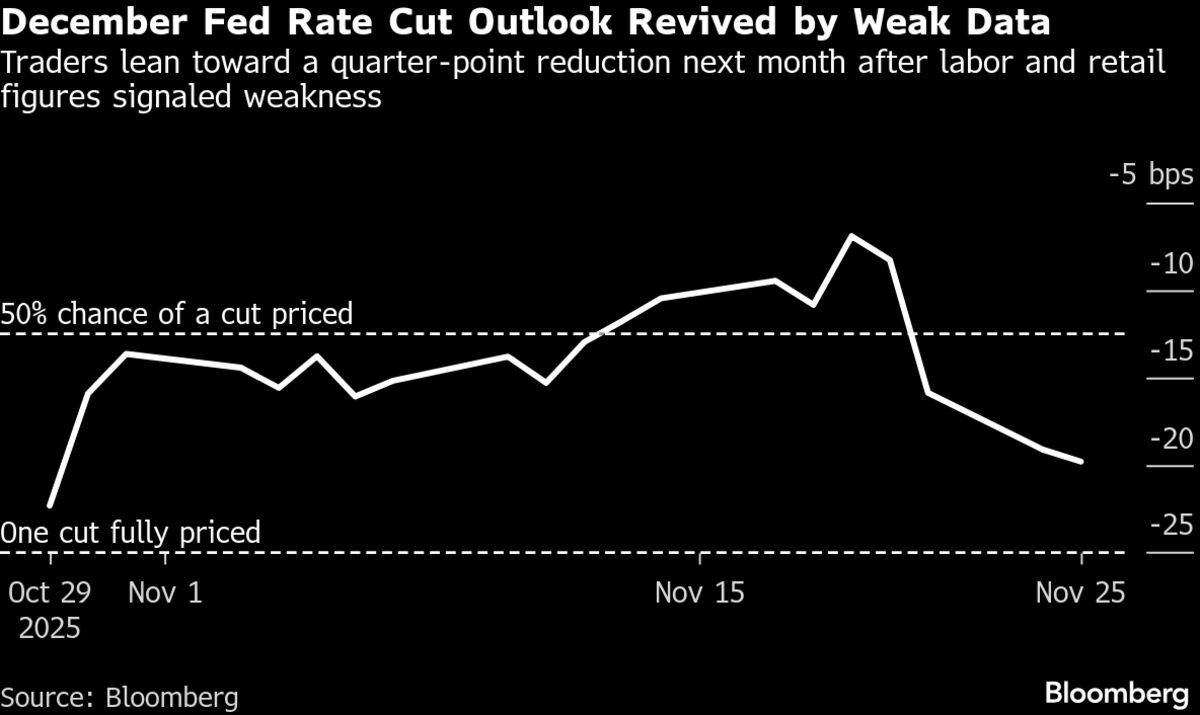

- Katrina Dudley, Senior Investment Strategist at Franklin Templeton Public Markets, highlighted the prevailing skepticism in the markets and the challenges facing the Federal Reserve in potentially cutting interest rates in December. She discussed these issues during an interview with Bloomberg's Lisa Abramowicz and Dani Burger.

- The insights from Dudley underscore the complexities of the current economic landscape, particularly the health of the US consumer and the Federal Reserve's cautious stance on monetary policy, which may impact investment strategies and market confidence.

- This discussion reflects broader concerns among economists and market strategists regarding the Federal Reserve's ability to navigate rising unemployment and inflation pressures, as various experts express differing views on the necessity and timing of potential rate cuts.

— via World Pulse Now AI Editorial System