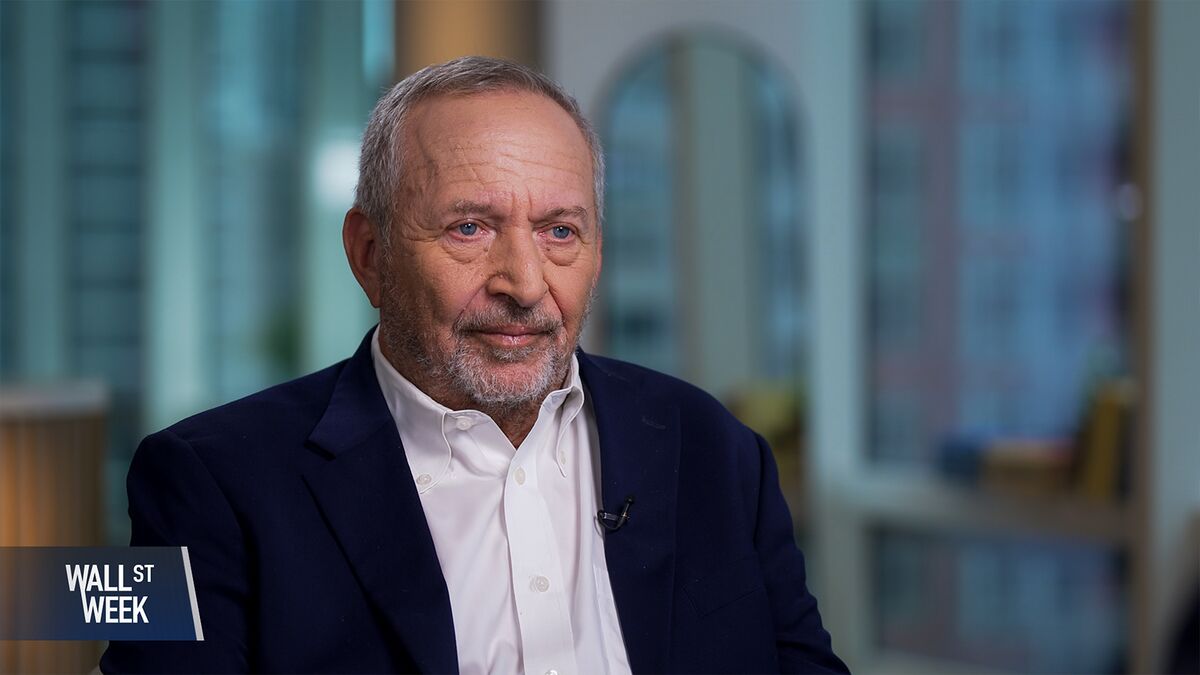

Wall Street Bets Rates Will Drop Much More Than the Fed’s Forecasts

PositiveFinancial Markets

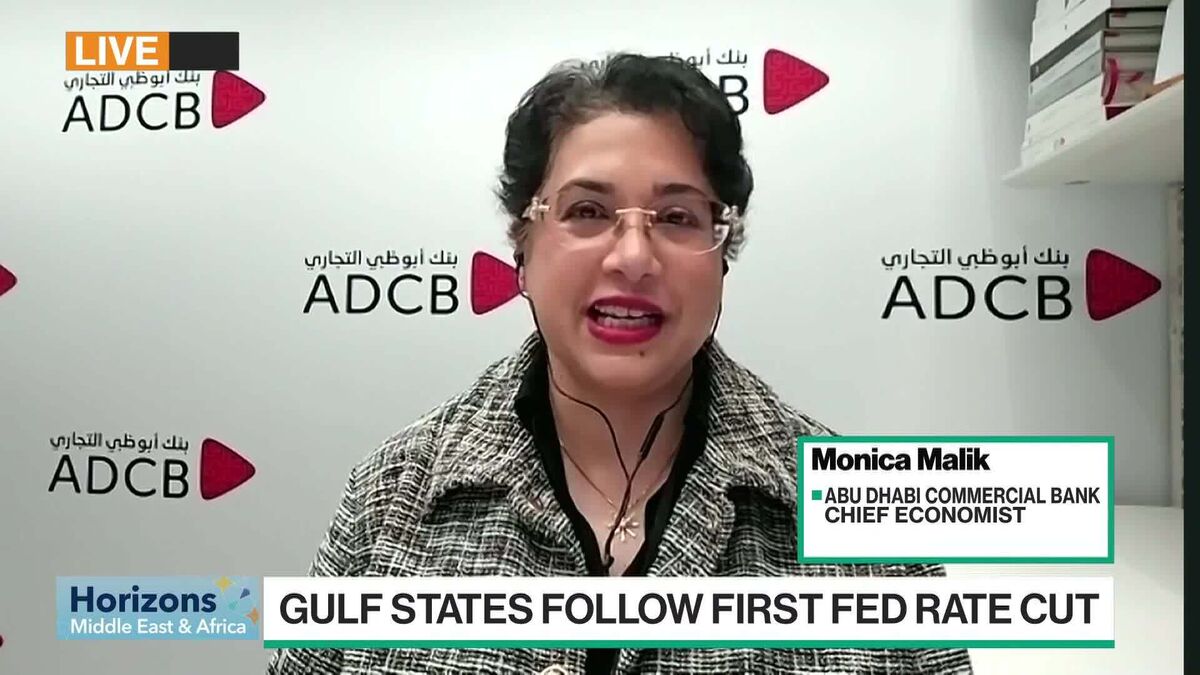

Investors are feeling optimistic as futures markets indicate that interest rates could drop below 3% by the end of next year, a significant shift from the Federal Reserve's forecasts. This potential decrease in rates could lead to more accessible borrowing and stimulate economic growth, making it an important development for both consumers and businesses.

— Curated by the World Pulse Now AI Editorial System