The Fed’s cut was ‘more hawkish than anticipated,’ Moody’s Zandi says — and warns it won’t be enough to stave off a looming jobs recession

NegativeFinancial Markets

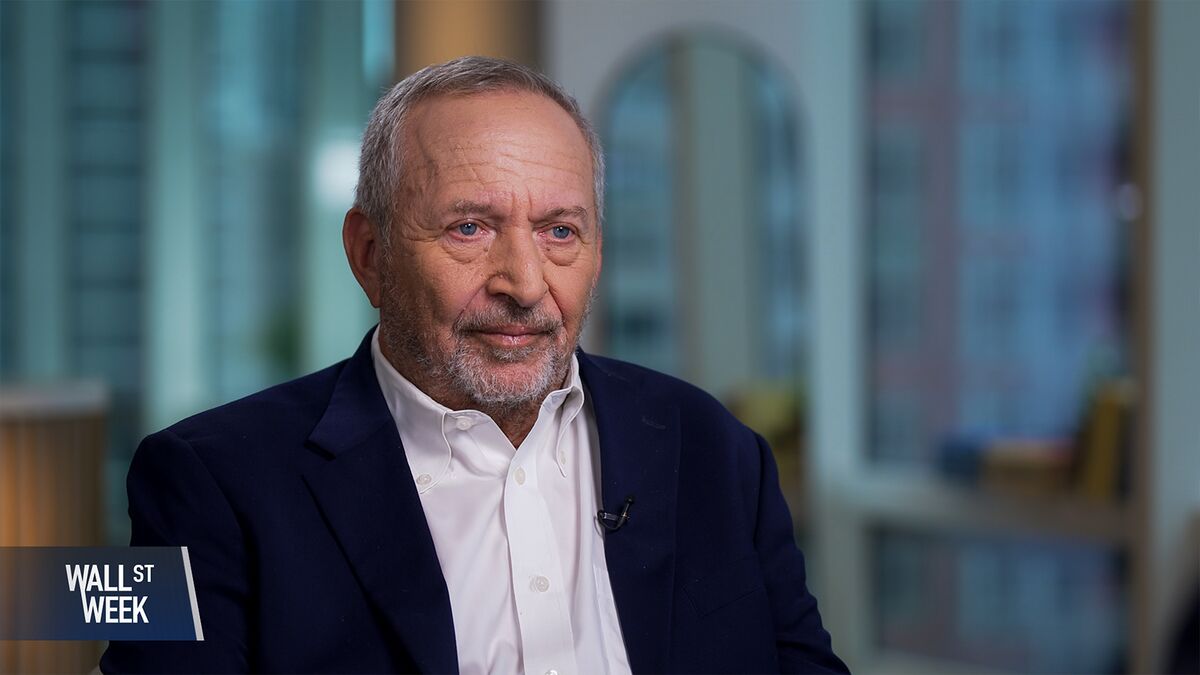

Moody's chief economist Mark Zandi has described the Federal Reserve's recent interest rate cut as 'more hawkish than anticipated,' suggesting that it may not be sufficient to prevent an impending jobs recession. This is significant because it indicates that despite the Fed's efforts to stimulate the economy, the market's reaction shows a lack of confidence in the recovery, raising concerns about future employment rates.

— Curated by the World Pulse Now AI Editorial System