Connie Chung Discusses State of Media Industry, FBI Gambling Probe| Bloomberg Markets 10/23/2025

NeutralFinancial Markets

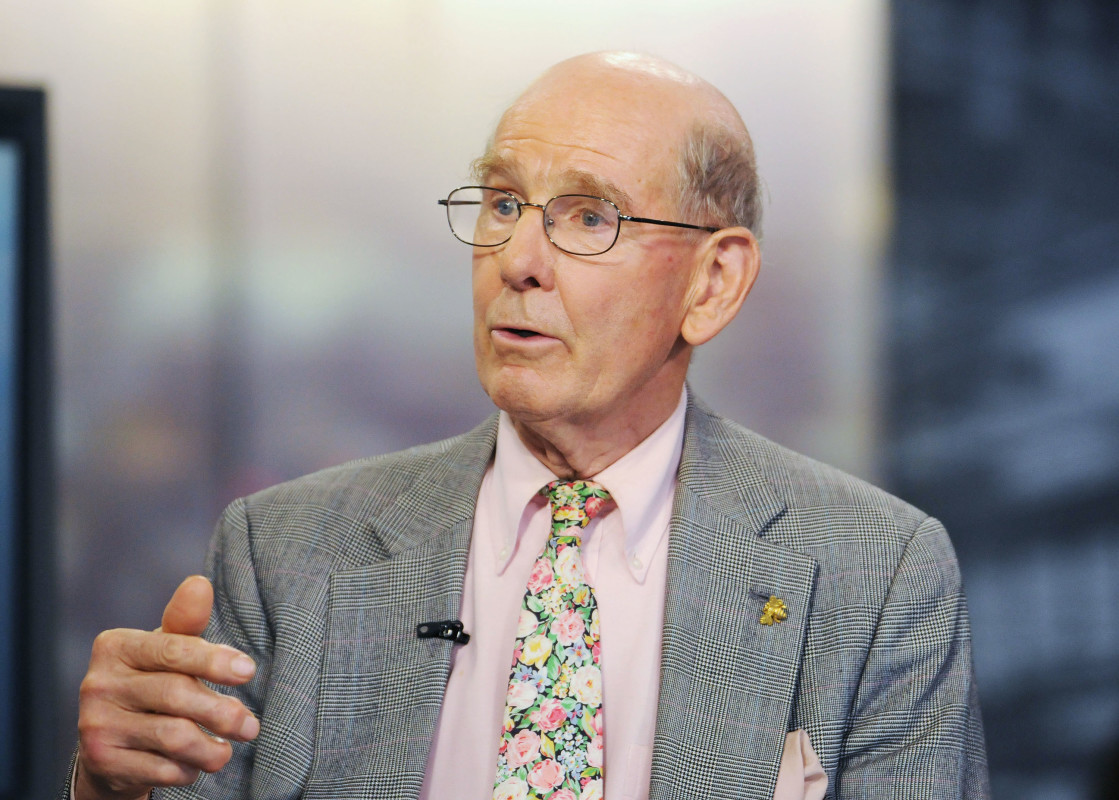

In a recent episode of Bloomberg Markets, award-winning journalist Connie Chung shared her insights on the current state of the media industry and the ongoing FBI gambling probe. This discussion is significant as it highlights the challenges and transformations within media, especially in the context of financial reporting and public trust. With prominent figures like Chung and Bloomberg's own analysts weighing in, viewers gain a deeper understanding of the intersection between media and major financial issues.

— Curated by the World Pulse Now AI Editorial System