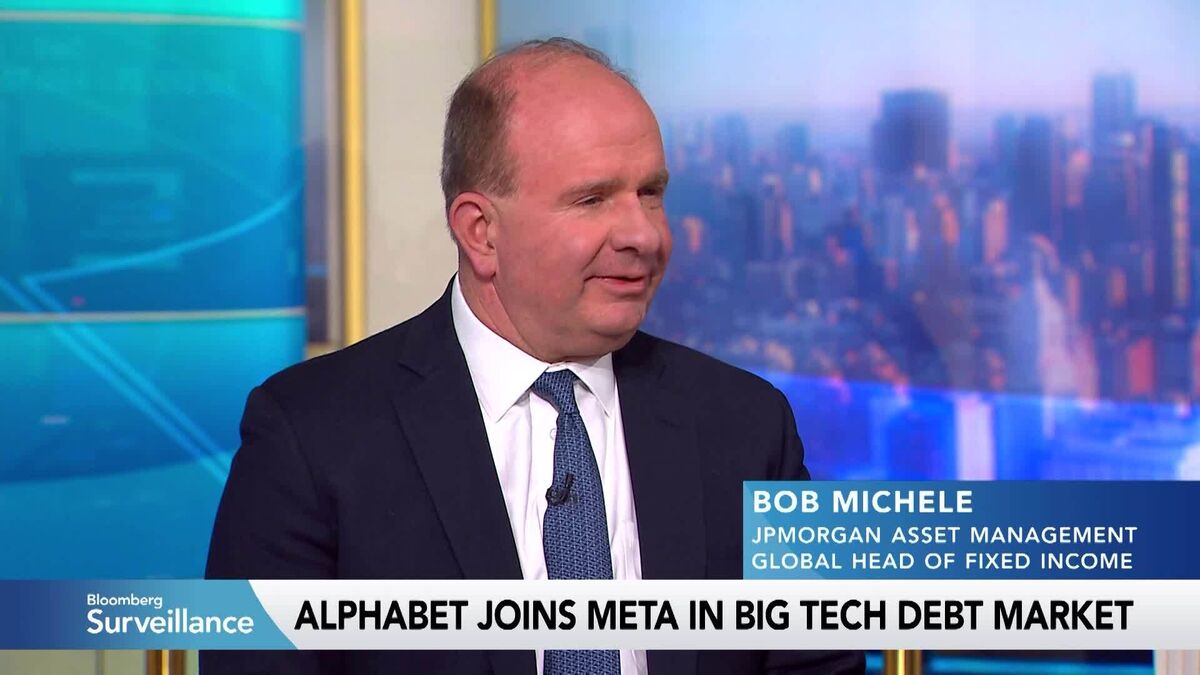

JPMorgan raises Standard Chartered stock price target to HK$190 on strong outlook

PositiveFinancial Markets

JPMorgan has raised its price target for Standard Chartered's stock to HK$190, reflecting a strong outlook for the bank. This adjustment indicates confidence in Standard Chartered's future performance, which is significant for investors looking for growth opportunities in the financial sector.

— Curated by the World Pulse Now AI Editorial System