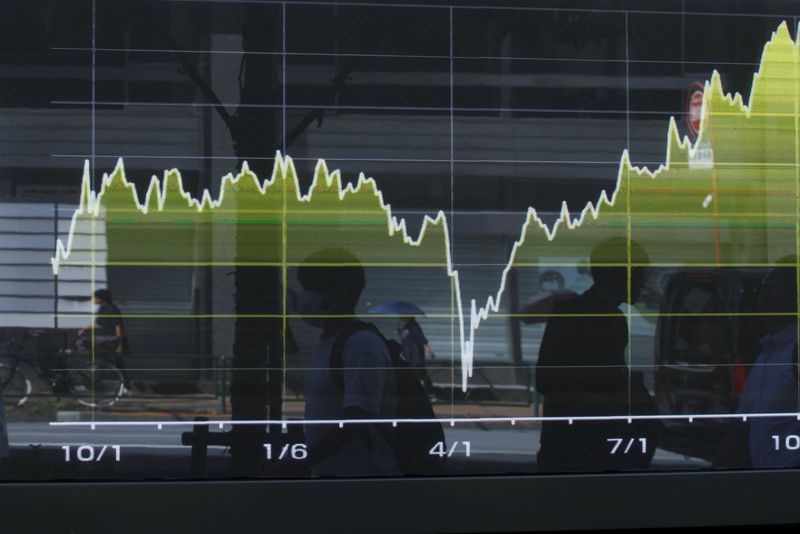

Emerging markets roar back with biggest stock rally in 15 years

PositiveFinancial Markets

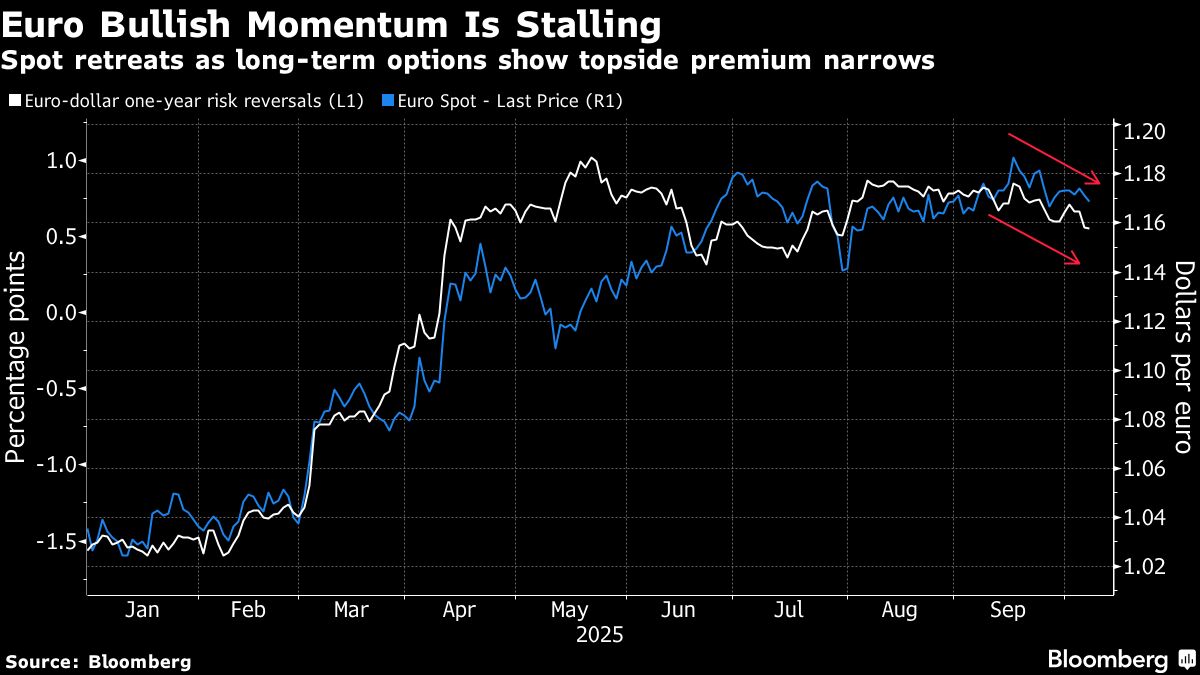

Emerging markets are experiencing their most significant stock rally in 15 years, driven by a weakening US dollar that has prompted investors to seek better yields. This resurgence is crucial as it signals renewed confidence in these markets, potentially leading to increased investment and economic growth in regions that have faced challenges in recent years.

— Curated by the World Pulse Now AI Editorial System