Stock Market Today: Dow Futures Edge Up

NeutralFinancial Markets

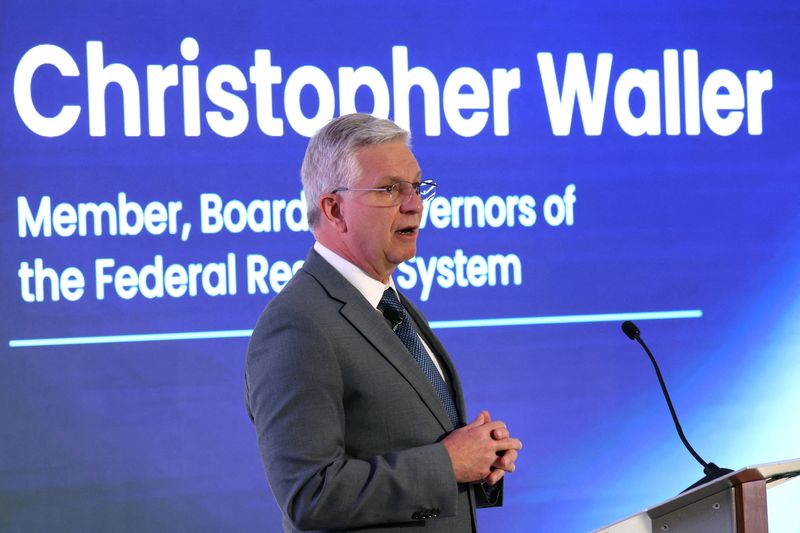

Today, Dow futures are showing a slight increase as investors look forward to upcoming financial earnings reports and speeches from several Federal Reserve officials. This is significant as it reflects market anticipation and could influence trading decisions in the near term.

— Curated by the World Pulse Now AI Editorial System