Copper Slides From Record as Traders Eye Trump-Xi Trade Talks

NeutralFinancial Markets

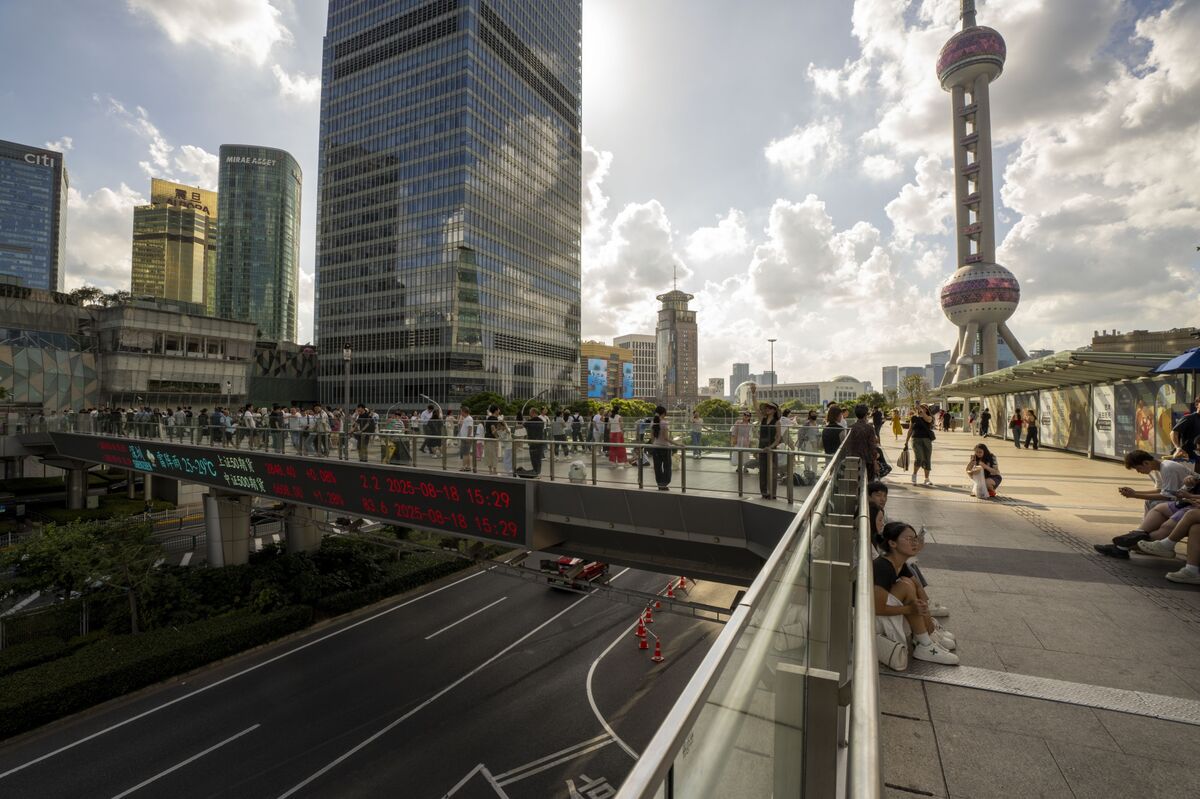

Copper prices have dipped after reaching a record high, reflecting a broader weakness in base metals. This shift comes as US President Donald Trump and Chinese President Xi Jinping engage in crucial trade discussions. The outcome of these talks could significantly impact global markets, making it essential for traders to stay informed.

— Curated by the World Pulse Now AI Editorial System