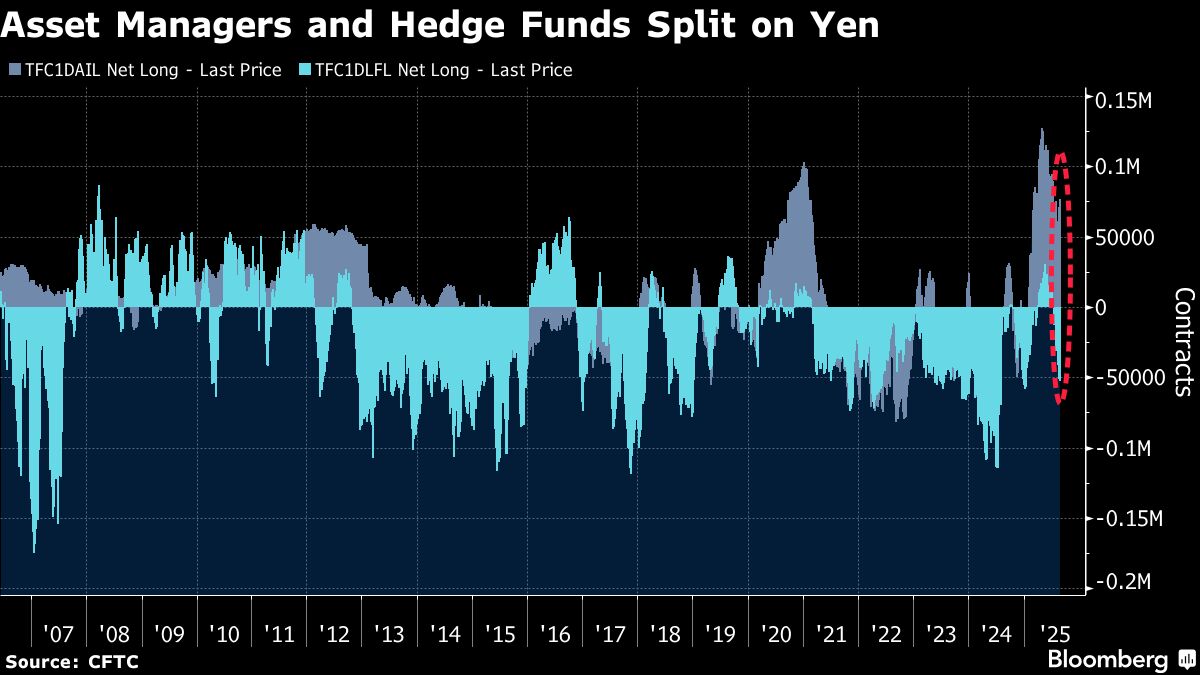

Hedge Funds Clash With Asset Managers on Where Yen Is Heading

NeutralFinancial Markets

Hedge funds are increasingly betting on a decline in the value of the yen, while asset managers remain optimistic, holding onto their bullish positions. This clash highlights the differing perspectives on Japan's currency and its future trajectory, which is significant for investors and the broader financial market.

— Curated by the World Pulse Now AI Editorial System