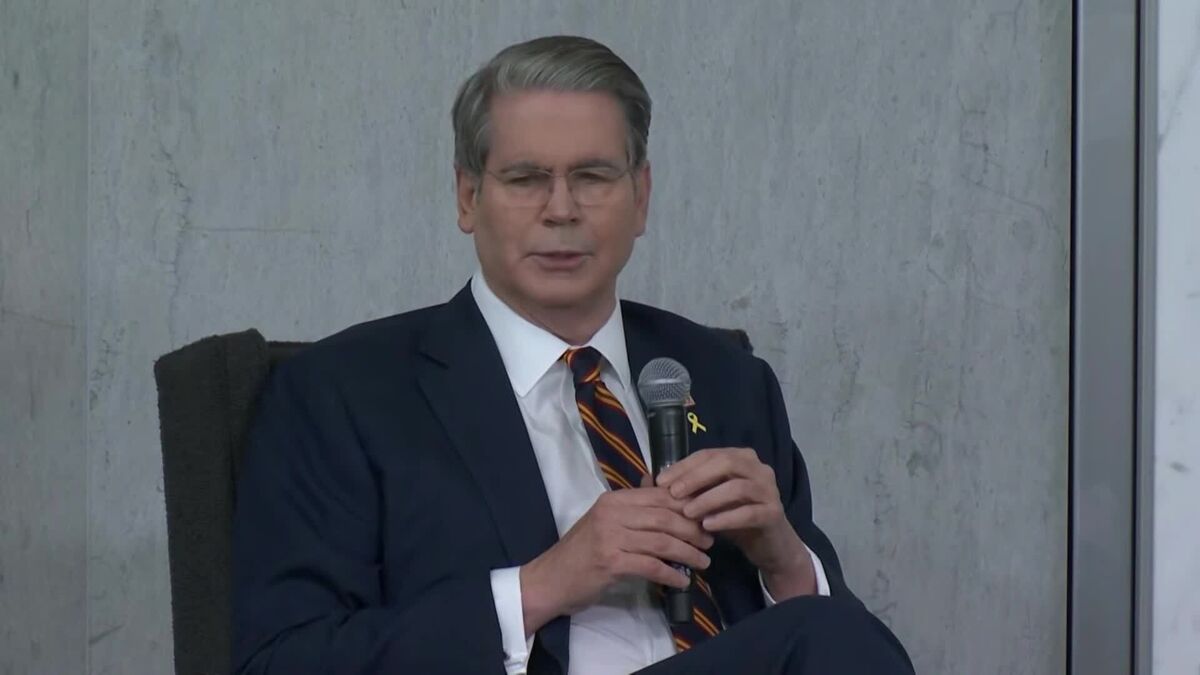

A Tough Job for Jay Powell at the Fed Gets Tougher

NegativeFinancial Markets

Jay Powell, the chair of the Federal Reserve, is facing increasing challenges as inflation continues to rise and interest rates are adjusted. This situation is significant because it impacts the overall economy, affecting everything from consumer spending to job growth. As Powell navigates these turbulent waters, the decisions made by the Fed will have lasting effects on financial markets and everyday Americans.

— Curated by the World Pulse Now AI Editorial System