Bessent: Private Credit Shows Regulation Is ‘Too Tight’

NeutralFinancial Markets

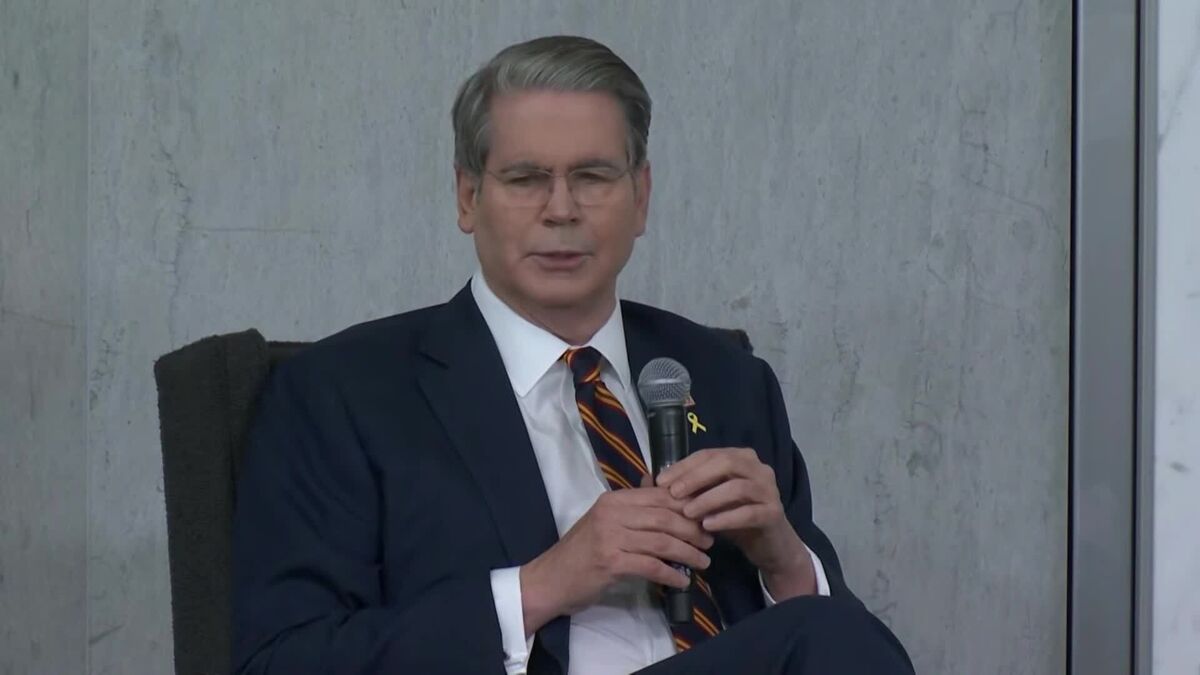

Treasury Secretary Scott Bessent recently expressed concerns about the current regulatory framework of the US financial system, labeling it as 'too tight.' Speaking at a community banking conference alongside Federal Reserve Vice Chair Michelle Bowman, he emphasized the need for a more commonsense approach to regulation. This discussion is significant as it highlights ongoing debates about the balance between necessary oversight and fostering a conducive environment for financial growth.

— Curated by the World Pulse Now AI Editorial System