Exxon and Chevron hike oil production despite global glut and see more ‘frontier exploration’ as U.S. shale boom slows

PositiveFinancial Markets

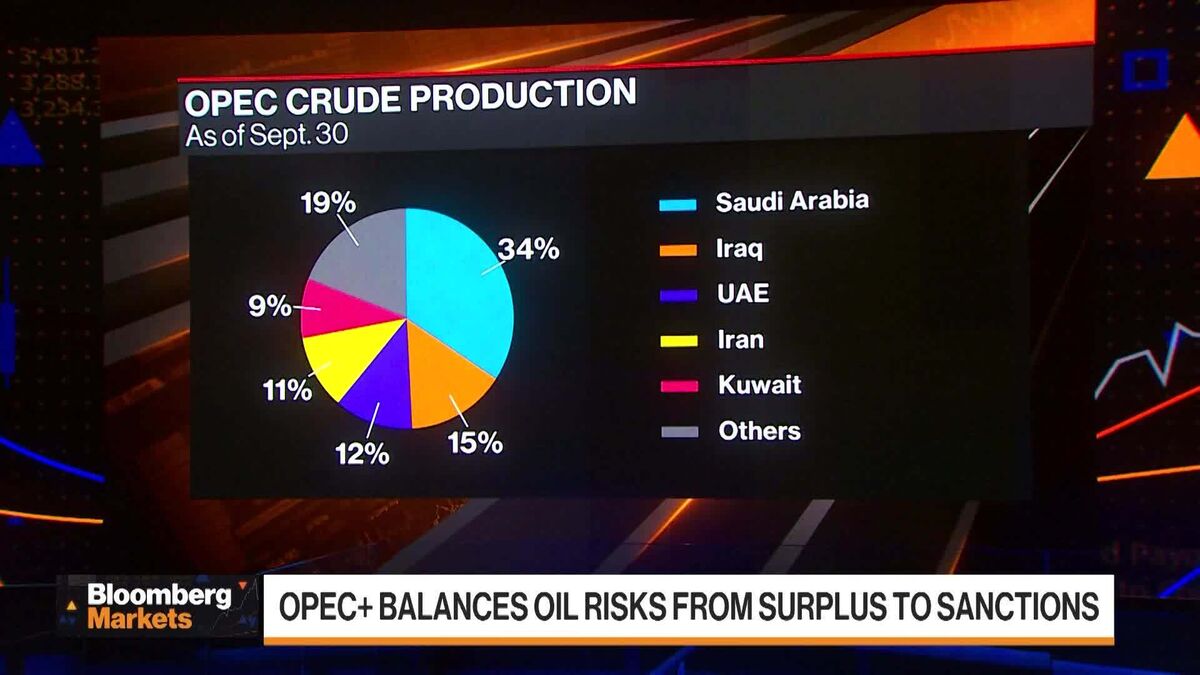

Exxon and Chevron are ramping up oil production even as the global market faces an oversupply. This move is significant as it highlights their commitment to frontier exploration in regions like Suriname, Brazil, and Angola, which could lead to new discoveries and opportunities. As the U.S. shale boom slows down, these companies are strategically positioning themselves to tap into new resources, ensuring their growth and stability in a changing energy landscape.

— Curated by the World Pulse Now AI Editorial System