Palantir Raises Outlook, But Valuation Concerns Grow

PositiveFinancial Markets

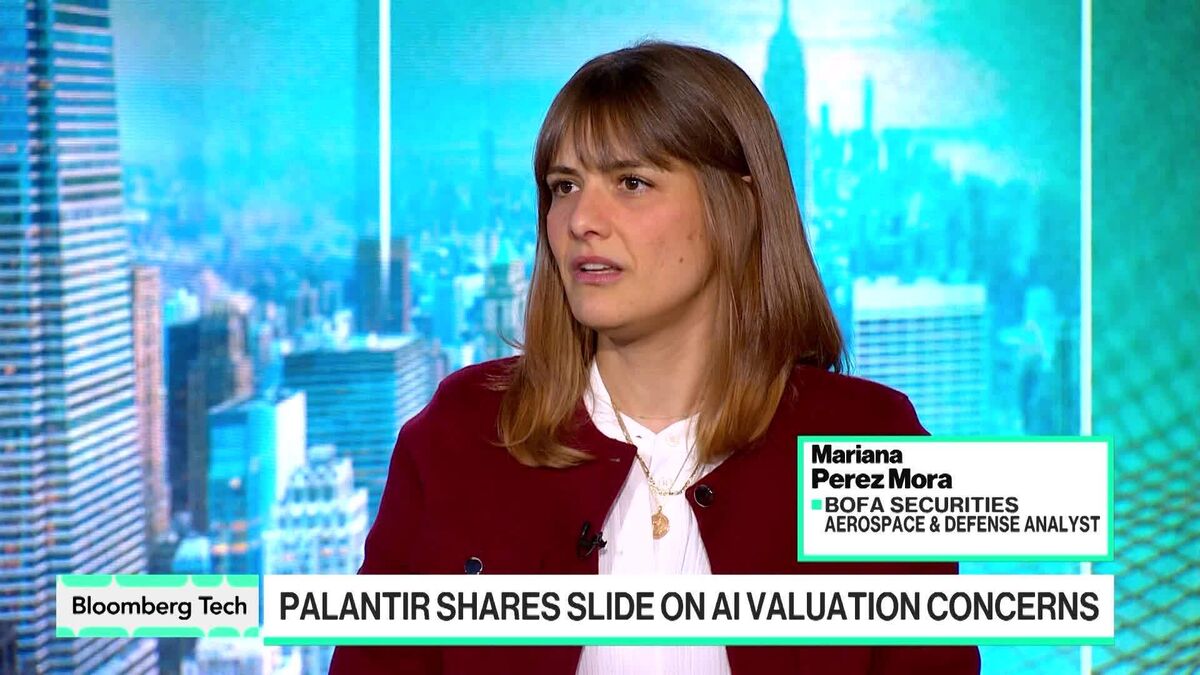

Palantir's outlook has been raised by BofA Securities Analyst Mariana Perez Mora, who believes the company will thrive even if the AI bubble bursts. She shared insights on Palantir's strong earnings and its unique position in the AI sector during a discussion with Caroline Hyde and Ed Ludlow on Bloomberg Tech.

— Curated by the World Pulse Now AI Editorial System