Palantir lifts 2025 sales outlook after posting strong quarterly growth

PositiveFinancial Markets

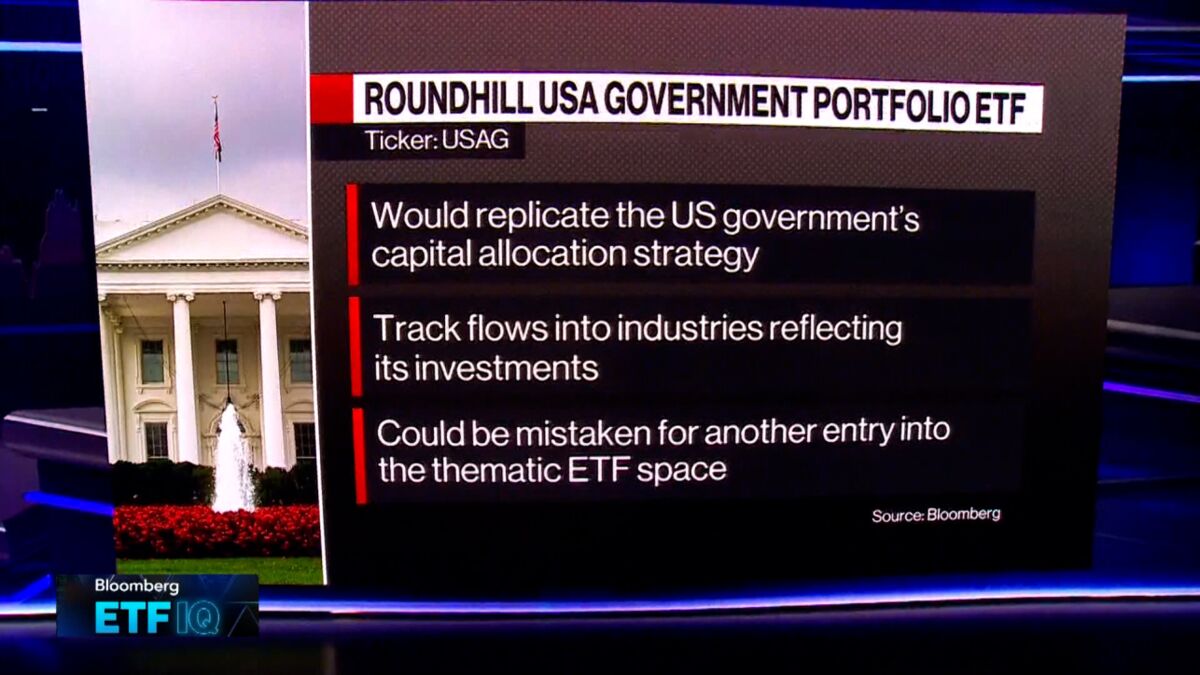

Palantir Technologies has raised its sales outlook for 2025 following impressive quarterly growth, driven by increasing contracts with both private companies and the US government. This surge in demand highlights the company's strong position in the data intelligence sector, showcasing its ability to adapt and thrive in a competitive market. Investors and stakeholders are optimistic about Palantir's future, as this growth could lead to more significant opportunities and innovations in data analytics.

— Curated by the World Pulse Now AI Editorial System