Stocks Near Record as Gold Tops $4,000 for First Time | The Close 10/8/2025

PositiveFinancial Markets

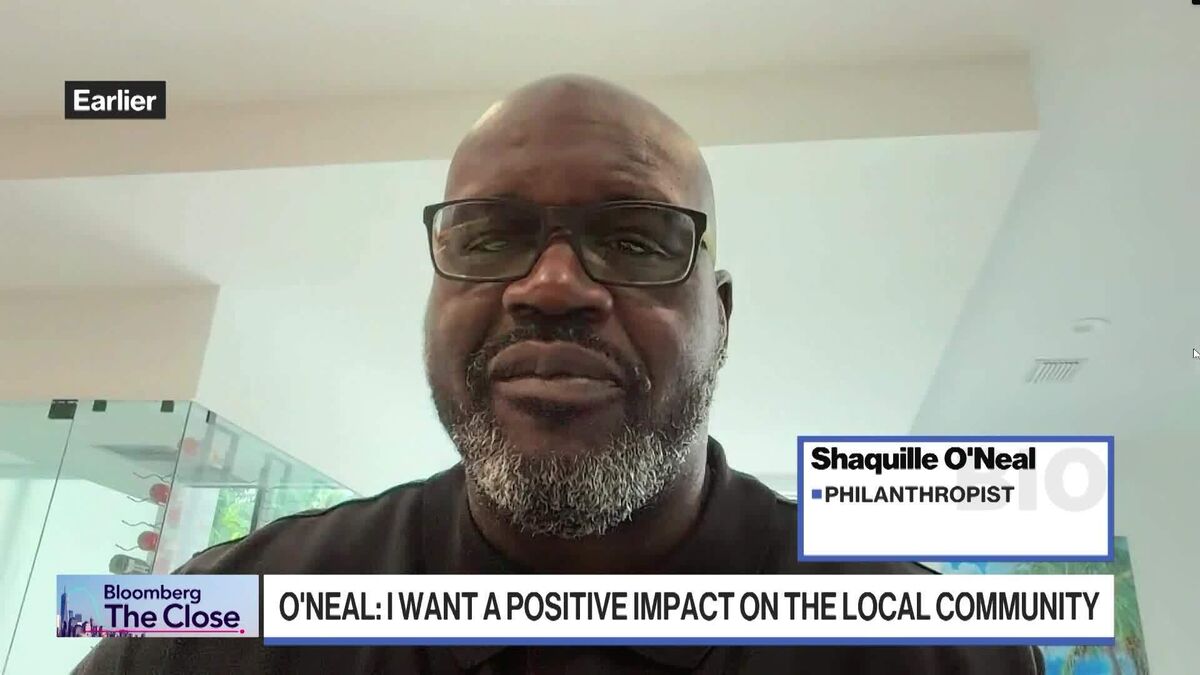

In a remarkable turn of events, stocks are nearing record highs as gold surpasses the $4,000 mark for the first time. This milestone is significant as it reflects investor confidence and a robust economic outlook. Bloomberg Television's coverage features insights from industry experts like Ronald Temple from Lazard and Betsy Graseck from Morgan Stanley, highlighting the factors driving these trends. The involvement of notable figures such as Shaquille O'Neal adds a unique perspective to the financial discussions, making this an exciting time for investors.

— Curated by the World Pulse Now AI Editorial System