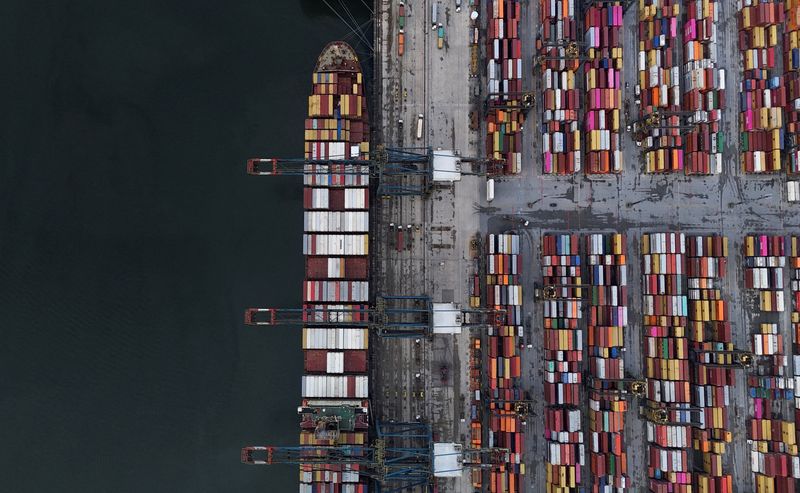

Asia Defies Slowdown Fears as AMRO Lifts Economic Growth Outlook

PositiveFinancial Markets

Asia's economic growth is projected to exceed expectations this year and next, according to the ASEAN+3 Macroeconomic Research Office (AMRO). This positive outlook is driven by robust local demand and proactive measures to mitigate the impact of tariffs. This matters because it indicates resilience in the region's economy, suggesting that Asian markets are adapting well to global challenges and could lead to increased investment and consumer confidence.

— Curated by the World Pulse Now AI Editorial System