Coffee products may be exempt from tariffs under new bill

PositiveFinancial Markets

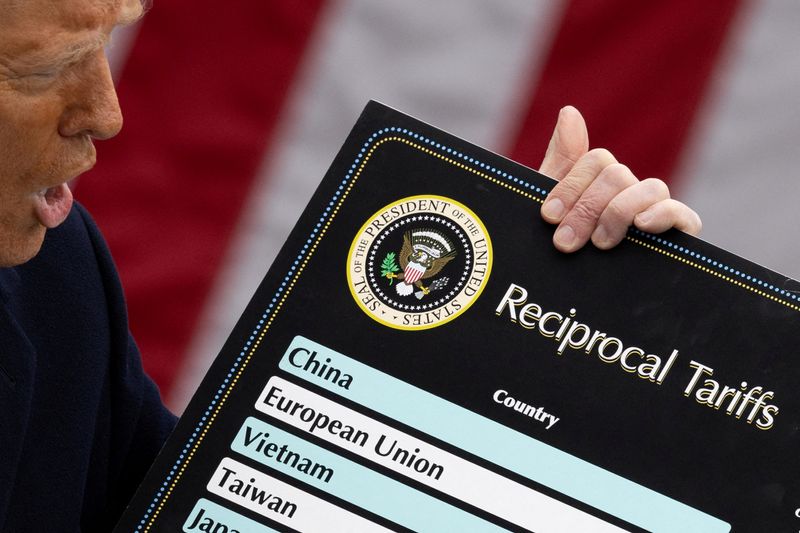

A new bill proposes that coffee products may be exempt from tariffs, which could significantly benefit consumers and businesses in the coffee industry. This exemption is important as it may lead to lower prices for coffee lovers and support local coffee shops, making it a win-win situation for both consumers and producers.

— Curated by the World Pulse Now AI Editorial System