Nvidia Becomes First Company Worth $5 Trillion

PositiveFinancial Markets

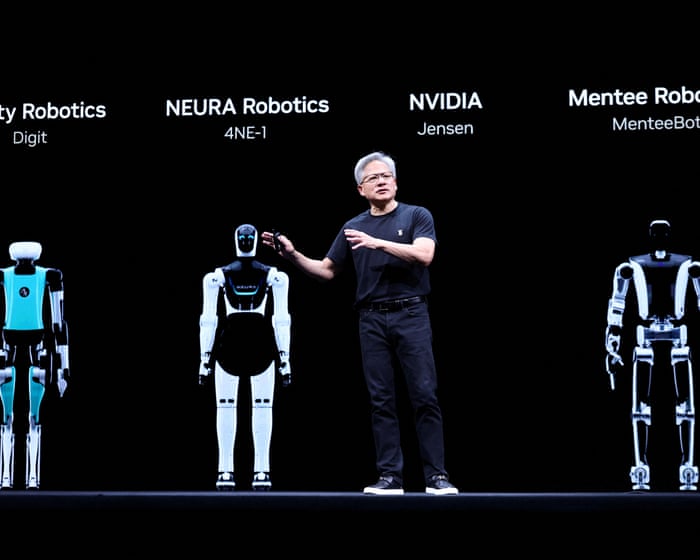

Nvidia has made history by becoming the first company to reach a market valuation of $5 trillion, a remarkable leap from just $10 billion a decade ago. This milestone highlights the explosive growth in demand for artificial intelligence technologies, positioning Nvidia at the forefront of the tech industry. As AI continues to shape various sectors, Nvidia's achievement not only reflects its innovative capabilities but also underscores the significant economic impact of AI advancements.

— Curated by the World Pulse Now AI Editorial System