Palantir’s ‘anti-woke’ playbook and ‘cultus’ winning strategy, after yet another earnings beat

NeutralFinancial Markets

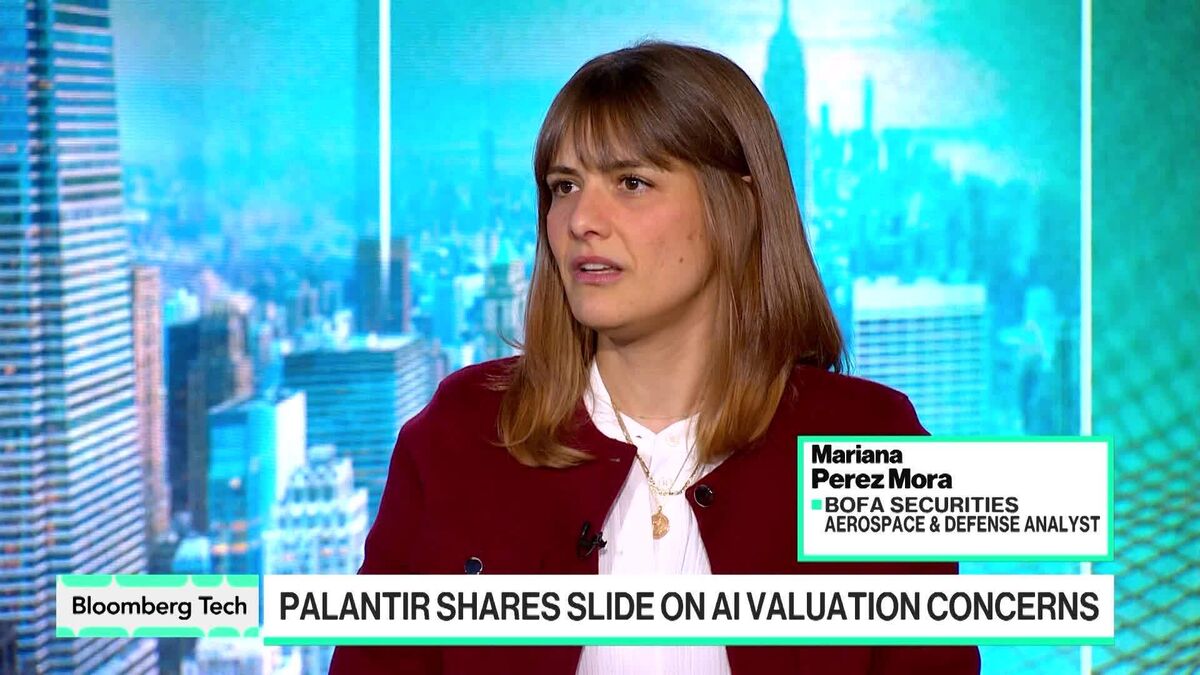

Palantir recently reported another earnings beat, but its shares dropped due to valuation concerns. CEO Alex Karp remains optimistic, stating that investors are on the right side of what should work in the country.

— Curated by the World Pulse Now AI Editorial System