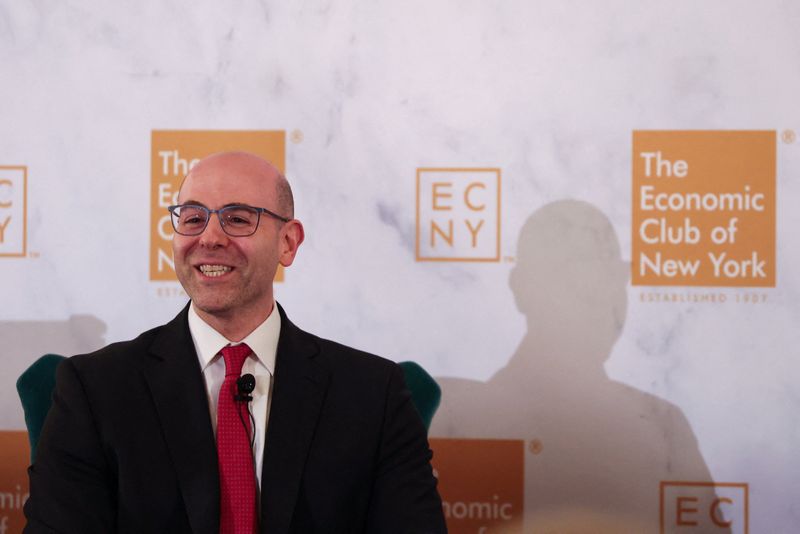

Community banking remains vital to local economies, says Fed’s Barr

PositiveFinancial Markets

In a recent statement, Federal Reserve official Barr emphasized the crucial role that community banking plays in supporting local economies. He highlighted how these banks provide essential financial services tailored to the needs of their communities, fostering economic growth and stability. This matters because strong local banks can better understand and respond to the unique challenges faced by their regions, ultimately contributing to a more resilient economy.

— Curated by the World Pulse Now AI Editorial System