Copper Hits Fresh All-Time High After Fed Delivers Rate Cut

PositiveFinancial Markets

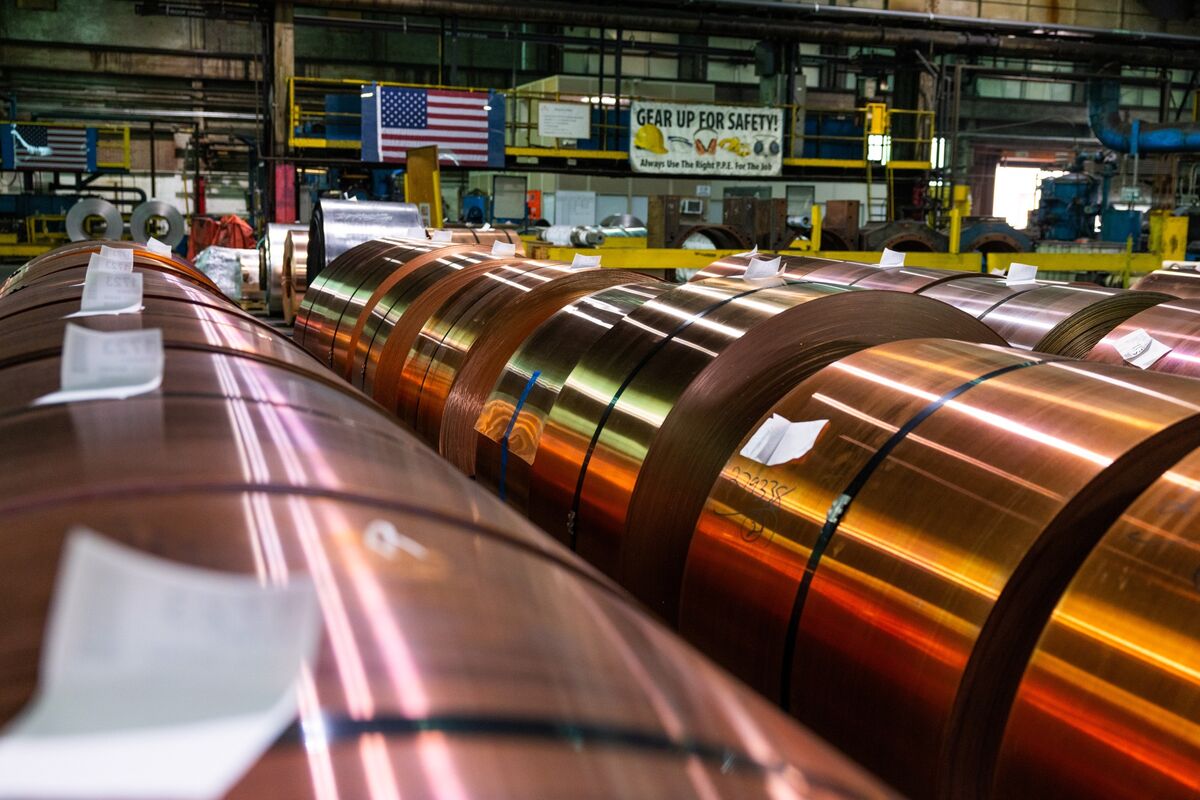

- Copper prices surged to a record high following the Federal Reserve's anticipated interest rate cut and an upgraded growth forecast for the US economy. This increase reflects heightened investor confidence in the metal's demand amid tightening supply dynamics.

- The rise in copper prices is significant as it indicates strong market sentiment and expectations for continued economic growth, which could influence investment strategies and commodity trading. The Federal Reserve's actions are seen as a catalyst for this upward trend.

- This development is part of a broader trend in the metals market, where concerns over supply shortages and increased stockpiling in the US have driven prices higher. Additionally, the positive sentiment surrounding potential monetary easing has also contributed to rising prices for other metals, such as silver, highlighting a growing investor focus on commodities amid economic uncertainties.

— via World Pulse Now AI Editorial System