European Stocks Gain as Fed Rate Cut Hopes Boost Sentiment

PositiveFinancial Markets

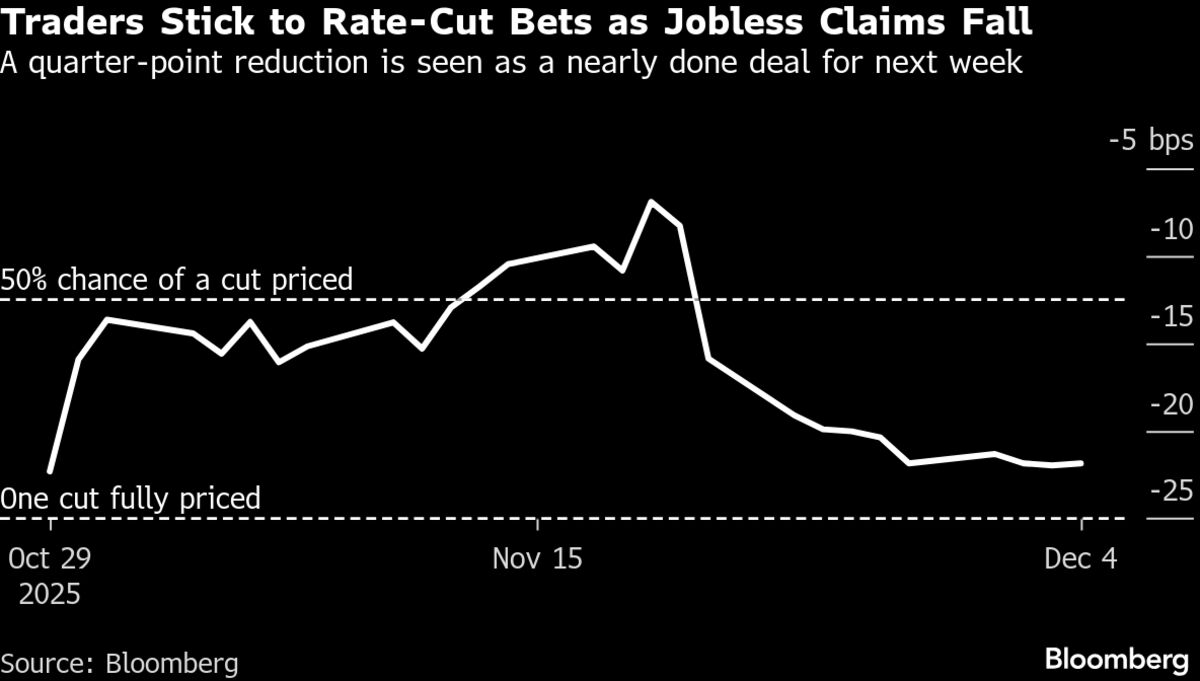

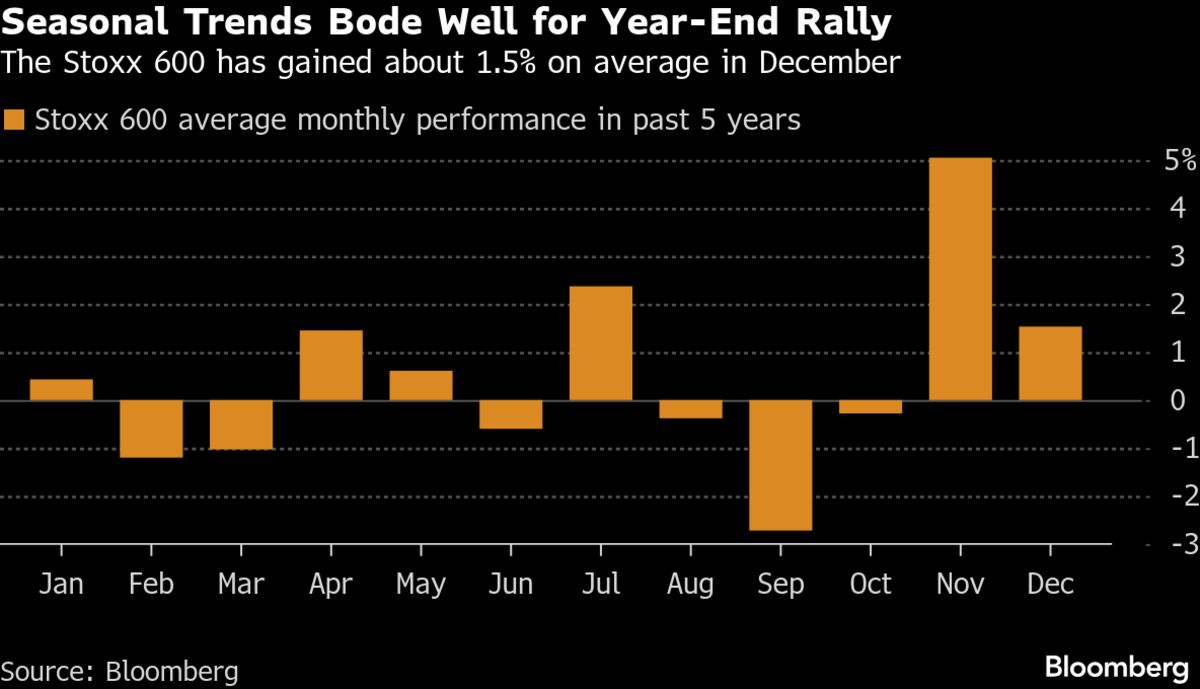

- European stocks rose on optimism that the Federal Reserve may cut interest rates, driven by indications of a slowdown in the US labor market. This sentiment reflects a broader trend of positive market reactions to potential monetary easing.

- The anticipated rate cut by the Federal Reserve is significant as it could lower borrowing costs, potentially stimulating economic growth and boosting investor confidence. This expectation has already begun to influence stock performance positively.

- The rise in European stocks aligns with similar trends observed in US markets, where stocks have also gained on expectations of rate cuts. This interconnectedness highlights a global investor sentiment shift, as markets react to labor market data and central bank signals, suggesting a cautious yet optimistic outlook for economic conditions.

— via World Pulse Now AI Editorial System