ECB Governing Council Member Says Price Effects of US Tariffs Still Unclear

NeutralFinancial Markets

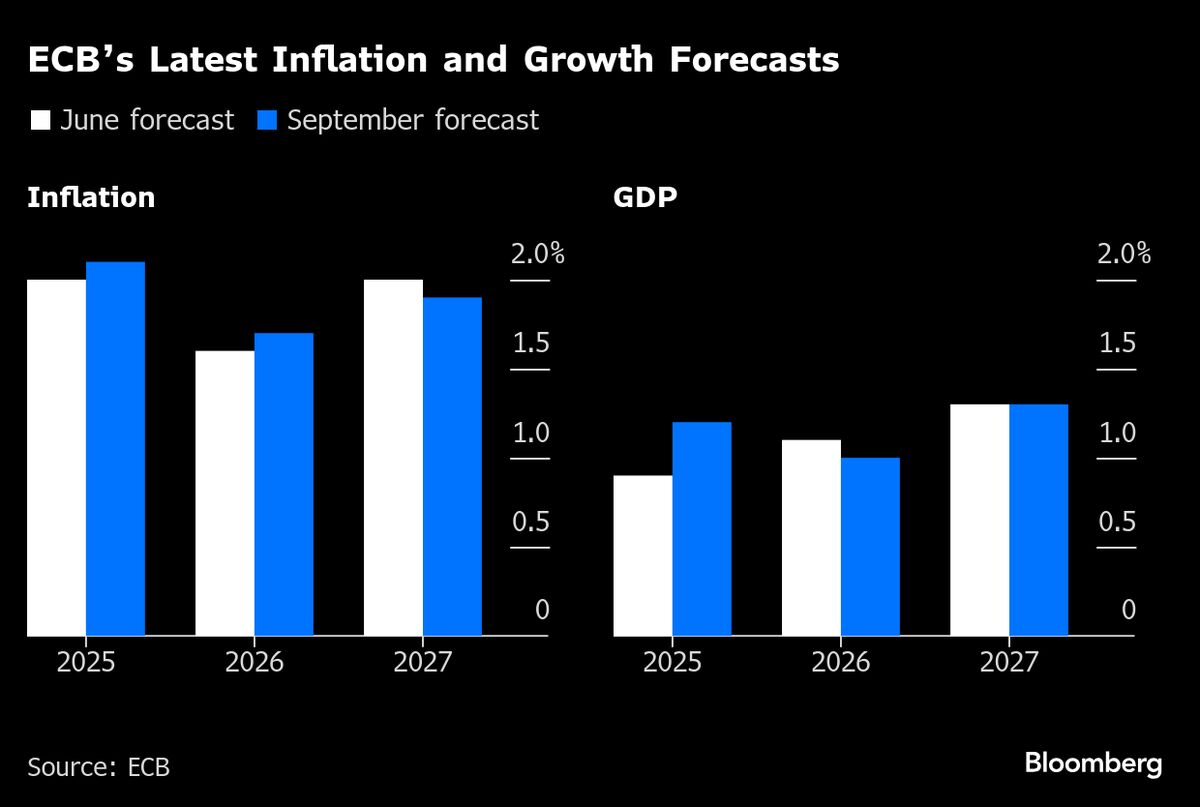

Edward Scicluna, a member of the European Central Bank's Governing Council, emphasized the need for caution regarding interest rate decisions. He pointed out that the impact of increased US tariffs on prices remains uncertain, suggesting that the ECB should wait for clearer data before making any moves. This is significant as it highlights the interconnectedness of global trade policies and monetary policy, which can influence economic stability in Europe.

— Curated by the World Pulse Now AI Editorial System