ECB’s Rehn Sees Two-Sided Risks to Europe’s Inflation Outlook

NeutralFinancial Markets

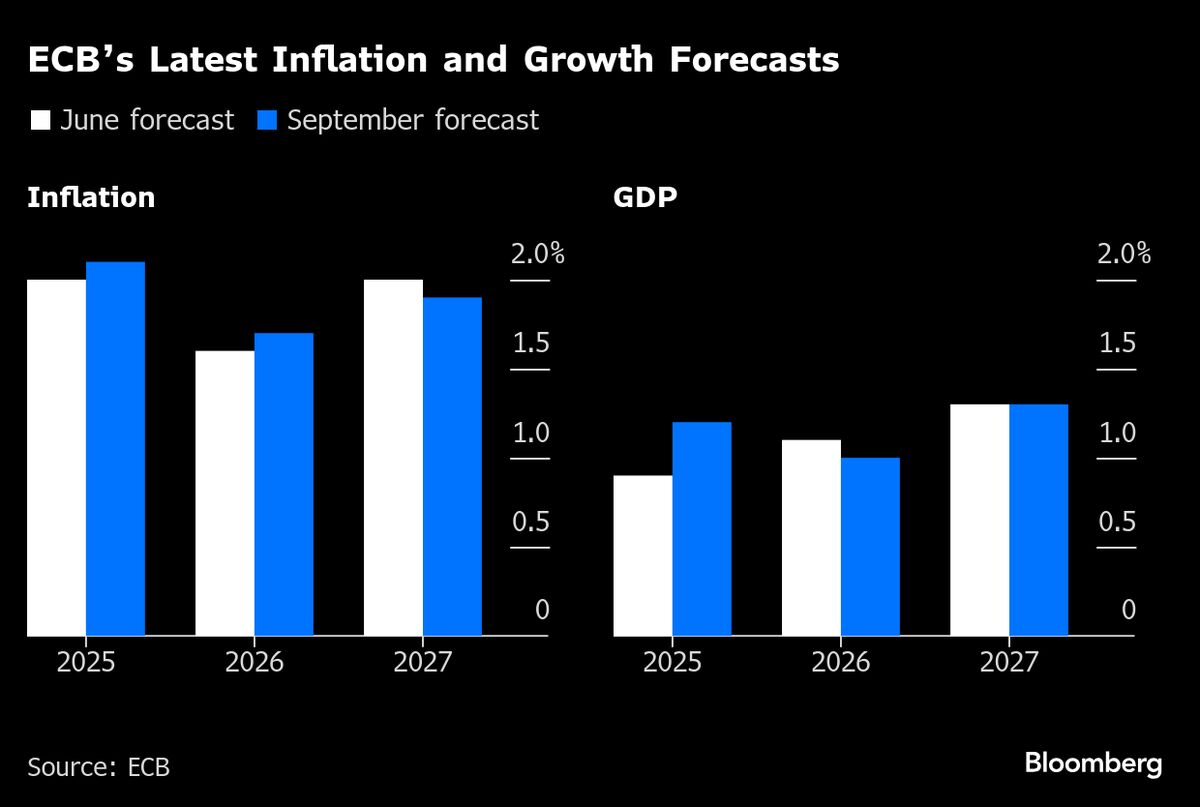

Olli Rehn, a member of the European Central Bank's Governing Council, has pointed out that the euro zone is currently facing inflation risks that could swing in either direction. This statement underscores the ECB's commitment to maintaining flexibility regarding interest rates, which is crucial for adapting to changing economic conditions. Understanding these dynamics is important for investors and policymakers as they navigate the complexities of the euro area's economic landscape.

— Curated by the World Pulse Now AI Editorial System